Jump to a section

No business can operate without risks. A local grocery store may face stock shortages due to supply chain issues, while a global conglomerate may experience disruptions due to unforeseen changes in compliance. All businesses inherently face various types of risks, including changing market conditions, fluctuations in interest rates, sudden regulatory changes, and many more.

This is why businesses, big or small, must plan to manage and mitigate risks, given that eliminating risks entirely is impossible.

A standalone local grocery store typically faces fewer and less complex risks compared to a multinational corporation with a global presence. That is, for larger companies facing a multitude of risks that can be more complex, more diverse geologically, or even more interconnected strategically, risk management software becomes indispensable to manage the complexity and scale of their risks effectively. Additionally, data protection is a significant concern, especially with the challenges posed by GDPR and other regulatory requirements.

Understanding local regulations is also essential, as risk management software must be designed to meet the unique compliance requirements and regulatory challenges faced by businesses in different regions.

In this article, we are going to walk you through what risk management software is, what features to look for, and some of the top providers to consider in 2026. Let’s get started.

12 Best risk management software for 2026

1. 4risk

2. Alyne

3. Corporater

4. Drata

5. Fusion

6. GOAT Risk™

7. MasterControl Risk™

8. Resolver

9. Riskonnect

10. ServiceNow

11. SoftComply Risk Manager

12. Sypro Risk Manager

Is risk management software on its own enough?

What is risk management software?

Risk management software provides businesses with the tools and frameworks to identify, assess, monitor, and mitigate potential risks.

Effective risk management involves a proactive approach to managing risks, including operational risk, third-party risk, and regulatory compliance. By implementing a robust risk management process, organisations can minimize risk exposure, ensure compliance with industry regulations, and maintain a strong risk culture. Risk management software is an essential tool in this process, providing organisations with the necessary tools and frameworks to identify, assess, and mitigate risks.

If something unexpected happens to your business, it could have different levels of impact. This might be something small, like having to spend a bit more money on office supplies because your usual supplier couldn't deliver on time. It's a bit inconvenient but doesn't cause major problems. On the other hand, in the worst-case scenario, the unexpected event could be very serious. For example, if a major distributor suddenly stops doing business with you, it could lead to a big financial loss. This might be so severe that your business struggles to survive or even has to close down.

That said, risk management software allows companies to systematically approach risk factors, maintain compliance, ensure continuity, and safeguard their business assets. The software aids in proactive decision-making and, as a result, enables businesses to navigate uncertainties and maintain resilience in the face of inevitable challenges.

Risk Management Software vs Enterprise Risk Management Software

Risk management software often focuses more deeply on managing specific types of risks within particular operational domains, while enterprise risk management software takes a bird's-eye view of risk across the entire organisation, aiming to align risk management with strategic objectives.

As an example, a manufacturing company may use risk management software to monitor equipment performance and maintenance schedules. The software allows the company to track machine conditions, schedule preventive maintenance, and alert management about potential equipment failures. This helps reduce downtime and ensure smooth production processes.

Another example would be a large university using enterprise risk management software to manage risks associated with its academic and operational activities. In this case, ERM software can help the university identify and assess risks related to student enrollment, research funding, and campus safety. It aligns risk management with the university's strategic plan to ensure academic excellence and financial stability.

Both software play crucial roles in ensuring that organisations can effectively manage risks, but they cater to different levels of the risk management spectrum.

Key features to look for in risk management software

To ensure that your risk management strategies and efforts remain proactive and adaptive to the changing risk landscape, any decent risk management software should come with the following features:

Risk identification

Risk identification is fundamental for any risk management software as it sets the stage for all subsequent risk management activities. Users can capture and document risks through various methods, such as brainstorming, interviews, and analysis. You should be able to categorise risks by, for example:

- Type – e.g., financial, operational, compliance

- Source – e.g., internal, external, human error, system failure

- Impact – e.g., high, medium, low; critical, major, minor

Risk assessment

Once risks are identified, they need to be evaluated and prioritised based on their likelihood and potential impact. At the very least, out-of-the-box frameworks and tools should be available to assess the severity of identified risks, such as risk matrices, scoring systems, and qualitative/quantitative analysis methods.

However, it's ideal to aim for a more comprehensive set of risk management tools where you can create, for instance, custom risk types, categories, and treatments, along with impact and probability levels.

Risk mitigation

Now that you have identified risks and assessed their potential impact, it's time to develop mitigation strategies and actions to minimise them. With risk mitigation tools, you should be able to create and manage risk response or treatment plans, assign related tasks, set deadlines, and monitor the implementation of these plans.

Risk monitoring

Risk management is not a one-and-done activity; it's a continuous and dynamic process, given that existing risks can evolve and new risks can emerge at any time. With tools for ongoing risk review, status updates, and alerts for any changes in risk status, you can continuously track identified risks and how effective their mitigation measures are – and vice versa.

Dashboards and reporting tools

It's a given that any risk management software today features customisable dashboards that display key risk indicators (KRIs), trends, and performance metrics, to name a few. The dashboard should provide a visual representation of risk data and insights, while reporting facilities should allow users to generate reports that summarise such information as needed.

Incident management

When an incident occurs, it must be analysed to understand the underlying risks that led to it. Within risk management software, you should be able to manage and respond to incidents that could escalate into significant risks.

Incident management tools provide structured processes for handling incidents – from logging incidents, tracking their progress, investigating their causes, and implementing corrective actions.

Compliance management

For companies in highly regulated industries such as banking and financial services, the energy and utility sector, and avionics and aviation, it is mandatory—and often legally required—to ensure adherence to internal policies and regulatory requirements set by governing bodies. For example, the Financial Conduct Authority (FCA) is the conduct regulator for around 50,000 financial services firms and financial markets in the UK and the prudential supervisor for 48,000 firms.

To a certain extent, your risk management software should allow for tracking compliance and obligations, conducting audits, managing documentation, and providing alerts for upcoming compliance deadlines and changes in regulations.

Document management

Document management facilitates the storage, retrieval, and sharing of risk-related documents, such as risk assessments, mitigation plans, and compliance reports.

While some organisations still rely on cloud storage or file-sharing platforms like Google Drive and OneDrive, these are not ideal, as such documents should be subject to version control and access permissions. What's more, robust document management tools can automate document workflows, ensure compliance, and provide comprehensive audit trails for better accountability and transparency.

Integration, customisability, and scalability

Last but not least, you should be able to integrate your new risk management software with other systems you are already using, such as ERP, CRM, and project management tools. The software should also allow you to customise interfaces to fit your business's branding and requirements, as well as scale in performance and capacity to handle increasing data and users as your business evolves.

Top 12 Risk Management Software

Each of the following risk management software solutions brings unique strengths to the table. While we can help provide a snapshot of them here, it's your call to decide which best suits your business. Remember to consider the scope of risk management needed, industry-specific regulations, and the level of integration with your existing systems.

1. 4risk

4risk is a part of Insight4GRC and is supported by one of the largest business advisory firms in the UK, RSM. It boasts itself as "a simple and cost effective cloud based risk management software" that makes risk and assurance management more efficient and effective. 4risk provides a comprehensive view of an organisation's risk, controls, and assurance in real time.

While 4risk offers assurance mapping facilities and robust reporting capabilities, some users might find the advanced analytics and data visualisation features less powerful than those of other high-end risk management solutions.

4risk's clients include Bangor University, Brunel University London, and Leeds City College.

2. Alyne by Mitratech

Developed by Mitratech, Alyne is in fact a cloud-based, AI-driven GRC software that provides a range of integrated solutions for enterprise and third-party risk management, compliance, and cybersecurity.

Thanks to its no-code, configurable dashboards powered by AI, Alyne provides CISOs and risk professionals with "around-the-clock, 360-degree visibility" of their company's risk and compliance profile. Tracking risks within the framework of risk management software is crucial, as it allows for effective identification and monitoring of potential issues. Users can also take advantage of over 1,500 out-of-the-box templates mapped to regulations and controls. Alyne, however, focuses heavily on cyber risk, which might not fully address the needs of companies looking for broader risk management functionalities.

Their clients include Charles Stanley, Allianz Ireland, and Yahoo.

3. Corporater

Empowering users to "manage risk holistically and with confidence," Corporater supports a wide range of risk management needs across various industries and aligns with several risk frameworks, including ISO 31000, COSO ERM, and ISO 27005. This risk management system is designed to help businesses reduce exposure to both operational and enterprise risks by facilitating risk identification, assessment, and mitigation, fostering a risk-aware culture while ensuring compliance with regulations and enhancing organisational processes through effective data management, and all from one central hub.

Corporater's robust customisation capabilities can be a double-edged sword: while these capabilities allow businesses to align risk management with their strategies, processes, and goals, the complexity of its features can pose a steep learning curve. This can make it less ideal for smaller organisations or those without dedicated risk management teams.

Their customers include E.ON, Gassco, and OBOS.

4. Drata

Positioning itself as a security and compliance automation platform, Drata allows businesses to "continuously monitor and collect evidence of [their] security controls, while streamlining workflows to ensure audit readiness."

Not only can users make use of 150+ pre-mapped controls and automated tests, but organisations can also customise risk owners, custom risks, and categories, providing comprehensive risk mapping. The platform supports over 20 compliance frameworks, including SOC 2, ISO 27001, HIPAA, GDPR, and PCI DSS. While automation reduces manual work, it requires organisations to trust Drata's automated processes and controls. Any malfunction could lead to compliance gaps or unaddressed risks, making continuous manual, supervision necessary.

Calendly, Lemonade, and Bramble all use Drata.

5. Fusion

Fusion Framework System is a risk management software that emphasises on "a customer-focused view of every situation," allowing users to proactively identify, analyse, and prioritise potential risks by mapping the relationships between risks across people, processes, places, systems, and third parties.

Their key features span risk program management, situational monitoring and risk analysis, risk tolerance and appetite, risk mitigation and control management, strategic and performance risk, and risk remediation, testing, and quality management. As Fusion is built on Salesforce, users are dependent on the Salesforce platform's performance, availability, and updates.

Their clients include Finastra, Fidelity Investments, and Boston Scientific Corporation (BSC).

6. GOAT Risk™

GOAT Risk™ is lauded for its simplicity and transparent pricing, starting from as little as £30 a month. This "easy to use, low cost risk management software" makes risk assessments easy for everyone, not just risk managers, thanks to its 'drag and drop' function.

While GOAT Risk™ offers standard features like risk profiles, risk registers, control assessments, action tracking, incident reporting, key risk indicators, and custom templates, the software does not currently offer Single Sign On (SSO) and any API functionality.

GOAT Risk™ serves customers such as LUCELEC and Cicor Group.

7. MasterControl Risk™

Designed with a focus on the life sciences and regulated industries, MasterControl Risk™ offers robust document control and quality management capabilities. This automated risk management software solution allows life science companies to quickly identify and mitigate risks in every phase of a product's life cycle.

Since MasterControl Risk™ is tailored to the dynamic, unique needs of the life science industry (e.g., regulatory compliance, clinical trials and research, and product quality and safety), the software facilitates "a consistent and comprehensive approach to risk management" with industry-specific features such as quality risk analysis and on-time out-of-specification (OOS) reporting. Naturally, it might be over-engineered for industries outside its primary focus.

Their customers include Thermo Fisher Scientific, Orthopediatrics, and EpiBone.

8. Resolver

Resolver risk management software can be utilised for various types of risk management, including enterprise risk management, third-party risk management, IT risk management, and security risk management.

The software itself emphasises incident and investigation management, allows for highly customisable reports, and integrates with third-party BI tools for advanced data visualisation, enabling users to "understand the interconnectedness of your risk and the effectiveness of your controls." Some users, however, find the reporting tools cumbersome and not as intuitive as expected.

Organisations such as SC Ventures, Bangor Savings Bank, and T-Mobile Netherlands use Resolver.

9. Riskonnect

Riskonnect boasts itself as "the world's largest risk management software provider." This integrated risk management software offers a suite of tools and features to support enterprise risk management (ERM), environmental, social, and governance (ESG), and claim management, among others.

The software centralises risk data so businesses can take full advantage of the visibility and intelligence to plan for and respond to all risks. Some users report that dashboards and reporting facilities can be complex and require a steep learning curve.

Riskonnect serves Vulcan Materials Company, Ameriprise Financial, and Elbit Systems of America.

10. ServiceNow

ServiceNow is a robust IT service management tool that has expanded into risk management with its GRC suite.

Helping companies "improve visibility and risk-related decisions with real-time intelligence," ServiceNow risk management solutions enable, for instance, fine-grained business impact analysis, operational risk assessments, and enterprise-level risk reporting. All of the ServiceNow products run on the Now Platform™, making it easier for organisations to integrate risk management with other business processes and IT operations. The extensive customisation options, however, can lead to overly complex configurations; some users report redundant features and functionalities that make the platform harder to navigate and manage at first.

Customers like Votorantim Cimentos, Uber, and Cognizant use ServiceNow.

11. SoftComply Risk Manager

SoftComply Risk Manager is "the 1st product risk management add-on for JIRA cloud" and is available for free for under ten users from Atlassian Marketplace.

The software is fully customisable to any risk management methodologies or approaches. It supports automated risk traceability, risk reporting in Confluence, a customisable risk matrix, a risk table/spreadsheet view, and risk management templates/guidance. Since it is built to be fully integrated with Atlassian Jira and Confluence, organisations not using Atlassian products will need to look for alternatives.

SoftComply Risk Manager customers include Boeing, Airbus, and Volta Trucks.

12. Sypro Risk Manager

Sypro Risk Manager is a "risk management software made simple," praised for its ease of use for tracking and managing risks and compliance tasks with a simple Red, Amber, and Green status.

The software provides a transparent, top-down view of organisational estate and asset structure. It facilitates compliance tracking, health and safety checks, and other risk-related tasks across multiple sites or facilities. It's worth noting that independent reviews and third-party validations are scarce.

Sypro Risk Manager serves clients across the UK, such as Marches Care, Wellspring Academy Trust, and Furness Education Trust.

Is risk management software on its own enough?

Risk management software on its own is typically not enough for a business, especially when it comes to ensuring comprehensive preparedness and resilience.

While risk management software plays a crucial role in identifying, assessing, and mitigating various risks, it does not cover all the aspects necessary for maintaining business continuity during disruptions. For example, it may not provide detailed recovery plans or emergency communication strategies that are essential for responding effectively to incidents and ensuring operations can continue with minimal interruption.

What's more, some industries require specific continuity plans (such as operational resilience in UK banking and financial services) and regular testing of these plans to meet regulatory and compliance requirements. Business continuity management software is designed to meet these requirements, whereas risk management software may not fully address them.

For a holistic approach to risk and resilience, businesses often use both software to ensure a more robust and comprehensive approach to managing risks and ensuring business continuity.

Choosing C2 for risk management and beyond

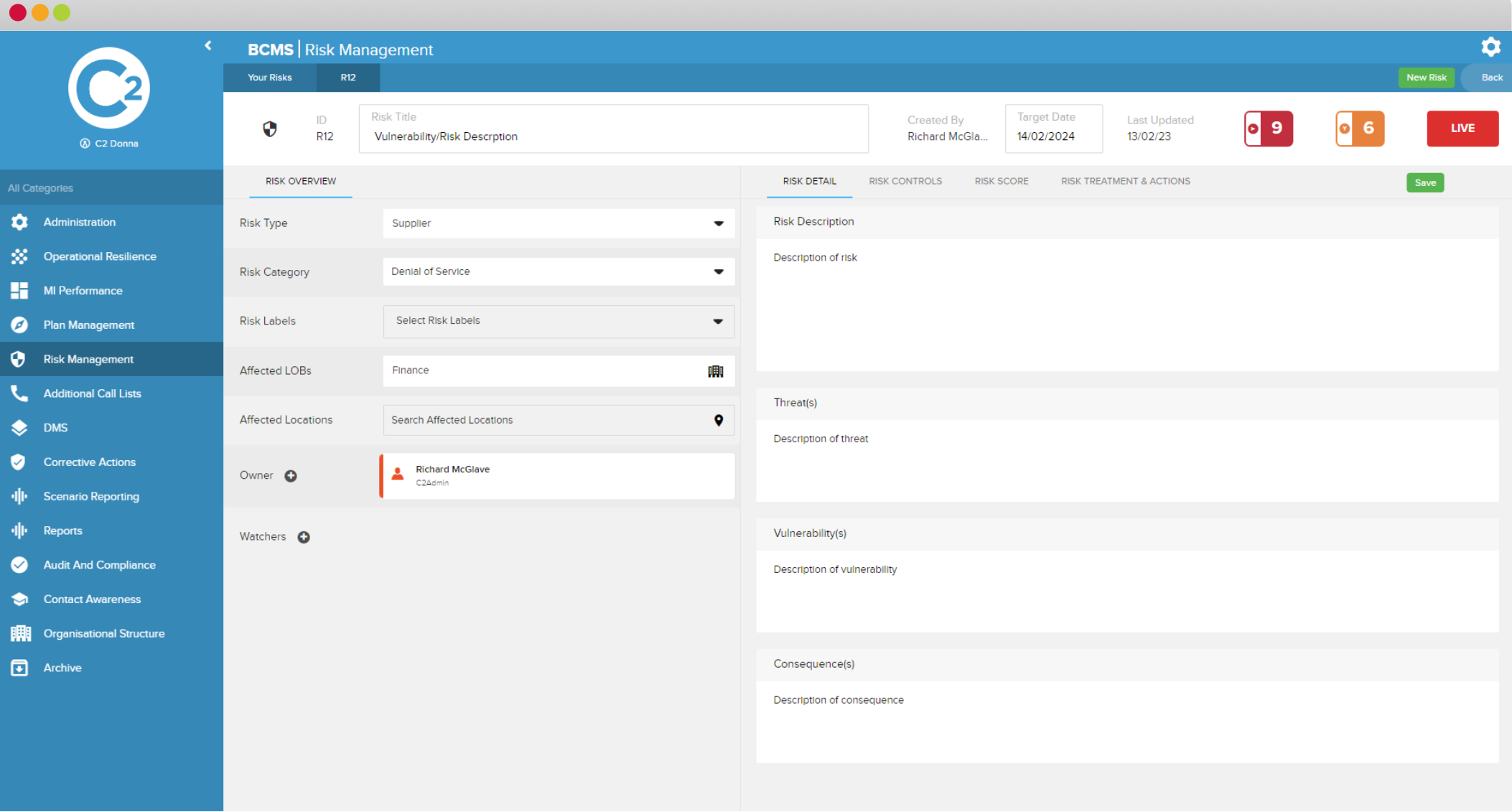

Our C2 Meridian BCMS software not only excels in facilitating business continuity management but also seamlessly integrates risk management within a single platform, thanks to its fully integrated risk management module.

Our risk management solution, which is powerful on its own, allows companies to create custom risk types, categories, labels, and treatments, along with impact and probability levels. Risks identified during business impact analysis and other assessments (e.g. system impact analysis (SIA) and disaster recovery planning) are automatically logged and scored, providing a clear view of your organisation's risk landscape.

Implementation and integration

Implementing and integrating risk management software requires careful planning and consideration.

Organisations should start by identifying their specific risk management needs and requirements, including the types of risks they need to manage, the level of risk assessment and mitigation required, and the need for compliance management and reporting. They should then select a risk management software that meets these needs, taking into account factors such as scalability, usability, and transparency of pricing. The software should be intuitive and easy to use, even for non-risk experts, and should provide a pain-free way to manage risks.

Once the software is selected, organisations should develop a comprehensive implementation plan, including training and support for users, to ensure a smooth transition and minimise disruption to business operations. C2's experts offer professional services to help our clients develop and enhance their approach to business continuity and operational risk. With as an important business operation as this, special care needs to be taken to ensure that it is implemented and integrated with other processes successfully.

Measuring success and ROI

Measuring the success and return on investment (ROI) of risk management software is critical to ensuring that the software is effective in managing risks and providing value to the organisation.

Organisations should establish clear key performance indicators (KPIs) and metrics to measure the effectiveness of their risk management software, including the number of risks identified and mitigated, the level of compliance achieved, and the reduction in risk exposure. They should also conduct regular reviews and assessments of their risk management processes and software, to identify areas for improvement and optimize their risk management strategies.

By measuring the success and ROI of their risk management software, organizations can demonstrate the value of their risk management efforts to senior management and stakeholders, and make informed decisions about future investments in risk management.

The future of risk management software

The future of risk management software is likely to be shaped by emerging trends and technologies, including artificial intelligence, machine learning, and cloud-based deployment. As organisations increasingly adopt digital technologies and operate in a more complex and interconnected risk landscape, they will require risk management software that is agile, flexible, and able to adapt to changing risk profiles.

Risk management software will need to provide real-time risk reporting and analytics, enabling organisations to respond quickly to emerging risks and stay ahead of the risk curve. Additionally, risk management software will need to be integrated with other business systems and processes, such as governance, risk, and compliance (GRC) systems, to provide a unified view of risk across the organisation.

By leveraging these emerging trends and technologies, risk management software will play an increasingly important role in enabling organisations to effectively manage risks and achieve their strategic objectives.

With C2 Meridian, you can automate risk management processes, reduce the administrative burden, and free up resources for more strategic activities. Book a demo today!

Written by Donna Maclellan

Lead Risk and Resilience Analyst at Continuity2

With a first-class honours degree in Risk Management from Glasgow Caledonian University, Donna has adopted a proactive approach to problem-solving to help safeguard clients' best interests for over 5 years. From identifying potential risks to implementing appropriate management measures, Donna ensures clients can recover and thrive in the face of challenges.

Written by Donna Maclellan

Lead Risk and Resilience Analyst at Continuity2

With a first-class honours degree in Risk Management from Glasgow Caledonian University, Donna has adopted a proactive approach to problem-solving to help safeguard clients' best interests for over 5 years. From identifying potential risks to implementing appropriate management measures, Donna ensures clients can recover and thrive in the face of challenges.