Jump to a section

Risk management can be a difficult and skilful discipline that requires many tools and analysis to master. Knowing how to identify, categorise, and understand risks to a business is of vital importance to any organisation.

Teams should be able to proactively predict and avoid issues that could affect the outcome of a project. Knowing how to define categories of risk and apply them to projects should be part of the skillset of any risk/resilience and project manager.

Risk Categories Definition

Risk categories are high-level classifications that should be applied to any project when it is in the planning stage. By actively choosing to identify risks that might occur, businesses can better plan for what might occur throughout. Both internal and external sources can be a source of risk, making it vital that proper consideration is made to ensure that all potential risk sources are accounted for.

Different organisations may choose to define risks on their own terms. Therefore, even if two companies operate within the same industry niche, they may choose to approach risk management and the categorisation of risks in very different ways.

Project vs Business Risks

Though companies choose to define types of risk by their own categories, there are two overarching categories that encompass many of these: project-level risks and business-level risks.

- Project-level risks will affect the results purely at a project level. They can often include factors such as poor budgeting or resource allocation. .

- Business-level risks have the potential to affect the overall business, though the root cause of the issue might be from a single project. They can include issues with governance or cybersecurity, amongst many others.

It is worth noting that a company's risk management plan should already address business-level risks. However, it is important to recognise that not every risk an organisation faces will be at this level. Project-level risks might be much smaller when considering the scope of overall operations, but the ripples they create can cause a big impact if they are not adequately accounted for.

Examples of Project-Level Risks

As stated above, project-level risks are likely to look very different for each company, as no two operate in precisely the same way. However, there are some common risk categories that are likely to crop up again and again.

- Financial risks are obviously tied to the costs of a project. Several factors could cause the rise of such a risk, such as the failure to secure funding, a sudden spike in the cost of materials, or possibly even simply an unrealistic budget.

- Strategic risks will involve the risks that need to be taken to get the project across the line. They could include employee retention and daily operations just as much as the project dependencies and planning processes.

- Performance risks are tied to the overall performance of the project. They could flag as undefined KPIs or poor research, or even just a mismanagement of deadlines.

- External risks are less predictable than internal ones but could still severely affect the project. They could include major weather events, legal and regulatory issues, or even just the long-term illness of a key team member.

Examples of Business-Level Risks

Some project-level risks could also be business-level ones, too, depending on their impact on the company as a whole. Though a risk might start with just one project team, if not handled correctly, it could quickly spread to the entire business. Common business-level risks an organisation might encounter include the following.

- Financial risks at a business level are usually tied to the finances of the business overall rather than just to one project. For example, if a company relies on seasonal sales across the summer rather than a full calendar, this might translate as a financial risk. .

- Reputational risks can be created if a negative impression of a brand influences other areas, such as sales or social media. When dealing with reputational risks, a clear crisis communications plan needs to be followed. .

- Compliance risks occur when a company operates in an industry with strict regulatory monitoring, such as the financial, energy and telecommunications sectors. By adhering to legal standards set down by regulatory and governmental bodies, organisations should find that they actively minimise any compliance risks they may face. .

- Security risks are those attached to any sensitive and confidential information that the company might hold. For example, organisations of all sizes should have extensive guidance around the creation and protection of passwords that could compromise operations.

Why Use Risk Categories?

Identifying risk categories is a beneficial practice for teams to ensure project deadlines can be met successfully and that the business is protected overall. Though it might seem obvious to just tackle risks as and when they occur, taking the extra step to explicitly define risk categories can help identify them proactively.

By grouping potential risks based on factors such as source, type, and severity, organisations can quickly identify where risk is most likely to occur. This could potentially lead to the root cause of the risk being addressed and monitored more closely.

While incorporating risk categories may appear as an additional operational step, it proves to be a valuable practice, yielding tangible benefits for a company's overall risk management strategy. Benefits that could arise as a result of using risk categories might look like:

- Mitigate or even fully eliminate preventable risks

- Create a structure and process for identifying and documenting new risks

- Streamline risk discovery, monitoring, and mitigation

- Identify and mitigate risks through factors rather than events

- Improves communications within and between teams

How to Identify and Define Risk Categories for Your Organisation

Identifying and defining risk categories will, more often than not, need to be an internal task, simply as every company will have different areas they wish to control and limit. Risk management can be tricky to define at times since there are so many factors that affect even just one project. This is why you need to have a good strategy for identifying risks and then a plan of action for mitigating them afterwards.

Common causes of risk often exist across different tasks. Without actively categorising and identifying these risks that carry the same cause, there is a high chance that they will impact projects again and again.

With risk categories established, teams will feel more confident tackling the full risk management process and will discover that they also have better risk responses than they did before. It is rare that a business risk will affect just a single project. By ensuring that there are processes in place to actively catch and minimise the strongest and most common problems (potentially two very different types of risk), a team will become more adept in spotting anomalies overall.

PESTLE

Though organisations should work to define their own categories, a good place to start will be with the PESTLE method, as this covers a variety of external factors that affect most businesses:

- Political

- Economic

- Social

- Technological

- Legal

- Environmental

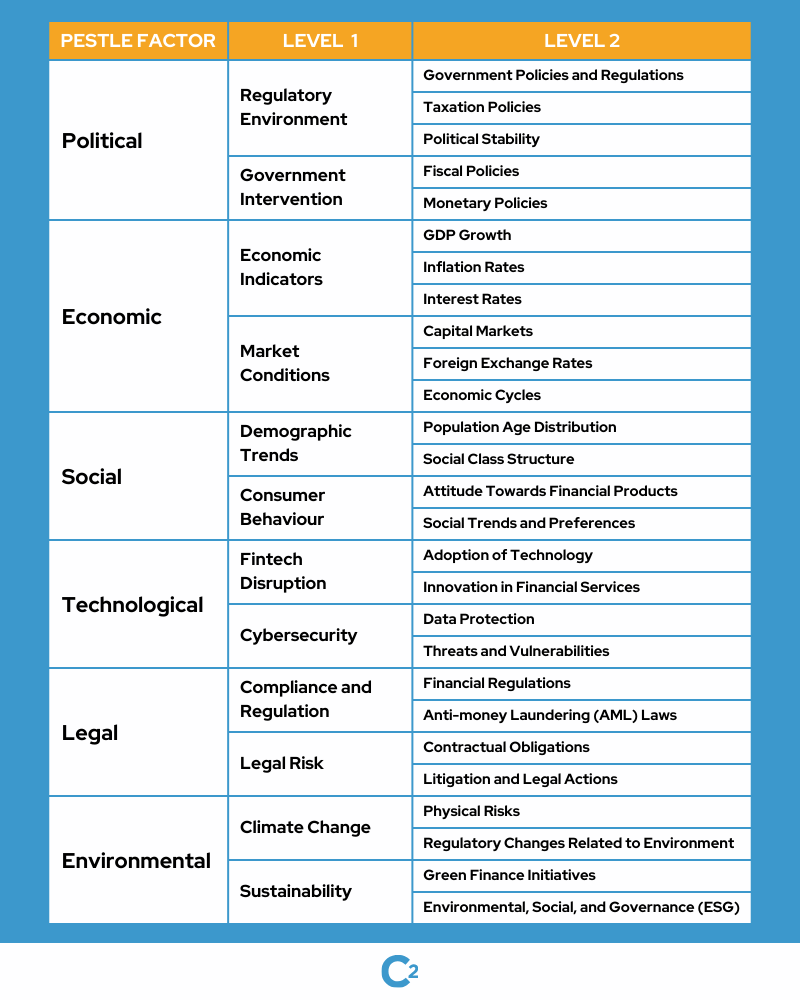

Here's what a generic risk identification framework might look like at a business level for a financial organisation using the PESTLE method:

As shown above, each section of risk can be broken down even further and more specifically. Going into this level of detail allows organisations to see the full scope of their projects and where issues could arise.

As an example, a financial organisation might encounter a cyber threat, testing their overall operational resilience as they defend themselves and get back on track. They can then check that this failure will impact other technological aspects of their operations, and whether or not there will be a greater impact on the business overall.

Categorise and Track Your Risks With C2 Meridian

Businesses need to ensure that they have a robust and proactive risk management system in place to mitigate and ease the impact critical events may have on their operations. To act without a risk management framework in the 21st-century world of business is nothing short of unacceptable. There are simply too many factors that cause upset if not adequately accounted for.

It also cannot be stressed enough that there is no one-size-fits-all approach to categorising risks. Though using structures like PESTLE can provide an initial scope of project risks, they cannot account for every unique factor that might affect an organisation. Therefore, it is critical that risk and resilience leaders work with their teams to establish a unique structure that is tailored perfectly to the ebb and flow of the wider business.

C2 Meridian is configurable to meet the unique requirements of your business, no matter what they might be. Our system aims to simplify the risk identification and management process, so that all the data and analysis that your team needs is readily available and as accessible as possible in one company-wide risk register.

Book a demo with us today and find out how we can help your organisation move forward with confidence.

Written by Donna Maclellan

Lead Risk and Resilience Analyst at Continuity2

With a first-class honours degree in Risk Management from Glasgow Caledonian University, Donna has adopted a proactive approach to problem-solving to help safeguard clients' best interests for over 5 years. From identifying potential risks to implementing appropriate management measures, Donna ensures clients can recover and thrive in the face of challenges.

Written by Donna Maclellan

Lead Risk and Resilience Analyst at Continuity2

With a first-class honours degree in Risk Management from Glasgow Caledonian University, Donna has adopted a proactive approach to problem-solving to help safeguard clients' best interests for over 5 years. From identifying potential risks to implementing appropriate management measures, Donna ensures clients can recover and thrive in the face of challenges.