Banking & Financial Services

Stay ahead of the curve of heightened financial regulations

Building Resilience in the Financial and Banking Sector with World-Leading BCMS

The world of finance and banking operates on a razor’s edge, where even the slightest disruption can have far-reaching consequences, especially with such vast amounts of sensitive data, transactions, and customer information.

With proactive business continuity planning and robust BC strategies, financial institutions can minimise downtime, maintain customer trust, and ensure the availability of essential services in times of disruptions.

Book a demo

Can you answer these questions with full confidence?

- Do you have documented procedures for handling liquidity and funding issues during disruptions?

- When were plans last checked, updated and tested?

- What measures are in place to protect against cyber threats and ensure the security of financial systems and sensitive data?

Planning for Business Continuity in the Financial and Banking Sector

Effective BC planning involves establishing critical functions, identifying potential risks and vulnerabilities, creating response plans by prioritising resources for quick recovery, training employees, and testing the plans regularly. Without a strategic approach in place, businesses may find it challenging to recover from crises, leading to significant financial losses, reputational damage, and even business failure.

Book a demoPrioritising Cyber Resilience for Financial Institutions

By implementing robust cybersecurity measures and conducting cyber-simulation exercises, financial institutions can proactively identify vulnerabilities, enhance incident response capabilities, and strengthen overall cyber resilience amid the increasing threat landscape of cyber-attacks.

Achieving and Maintaining Regulatory Compliance

From the FCA/PRA framework to ISO 22301, financial governance varies from region to region, and operational resilience is the universal ability of firms, and the financial system as a whole, to absorb and adapt to shocks, rather than contribute to them. Prioritising regulatory compliance is crucial for long-term success, trust, and business viability.

Book a demoUsing BCMS Solutions in the Financial and Banking Sector

Instead of spending manual hours planning and carrying out BC tasks, C2’s Meridian software allows financial and banking firms to create, store, manage, and distribute business continuity plans through smart automation and data collection. Investing in BC technology can help simplify and improve organisation-wide engagement.

Key Features of C2's Meridian BCMS

-

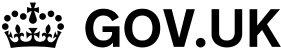

Management Information & Reporting

A real-time overview of your entire BCMS.

Find out more -

Business Impact Analysis (BIA)

Conduct, analyse, and get your BIA reports.

Find out more -

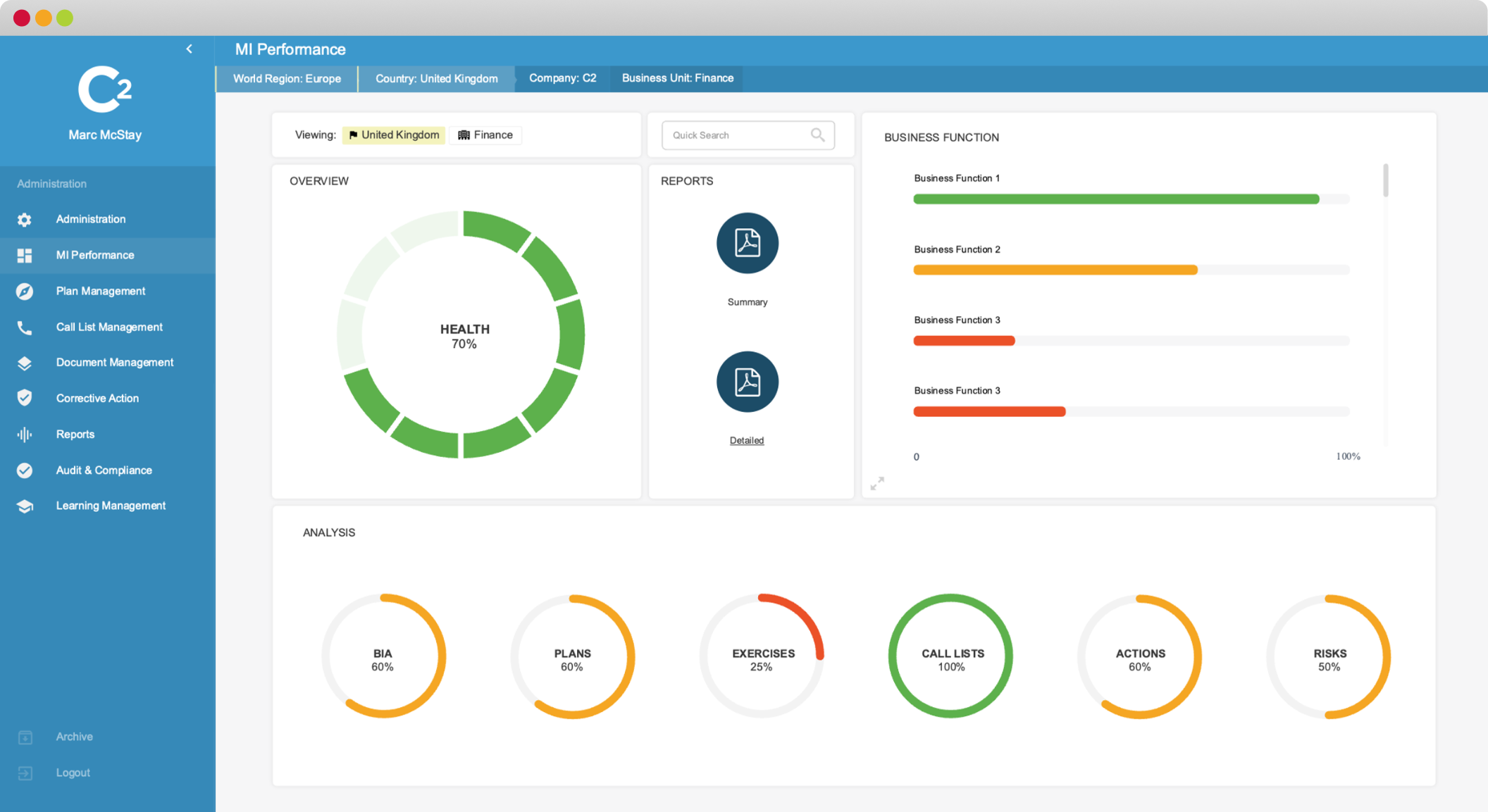

Plan

ManagementCreate any plans with ease with our Template Creator.

Find out more -

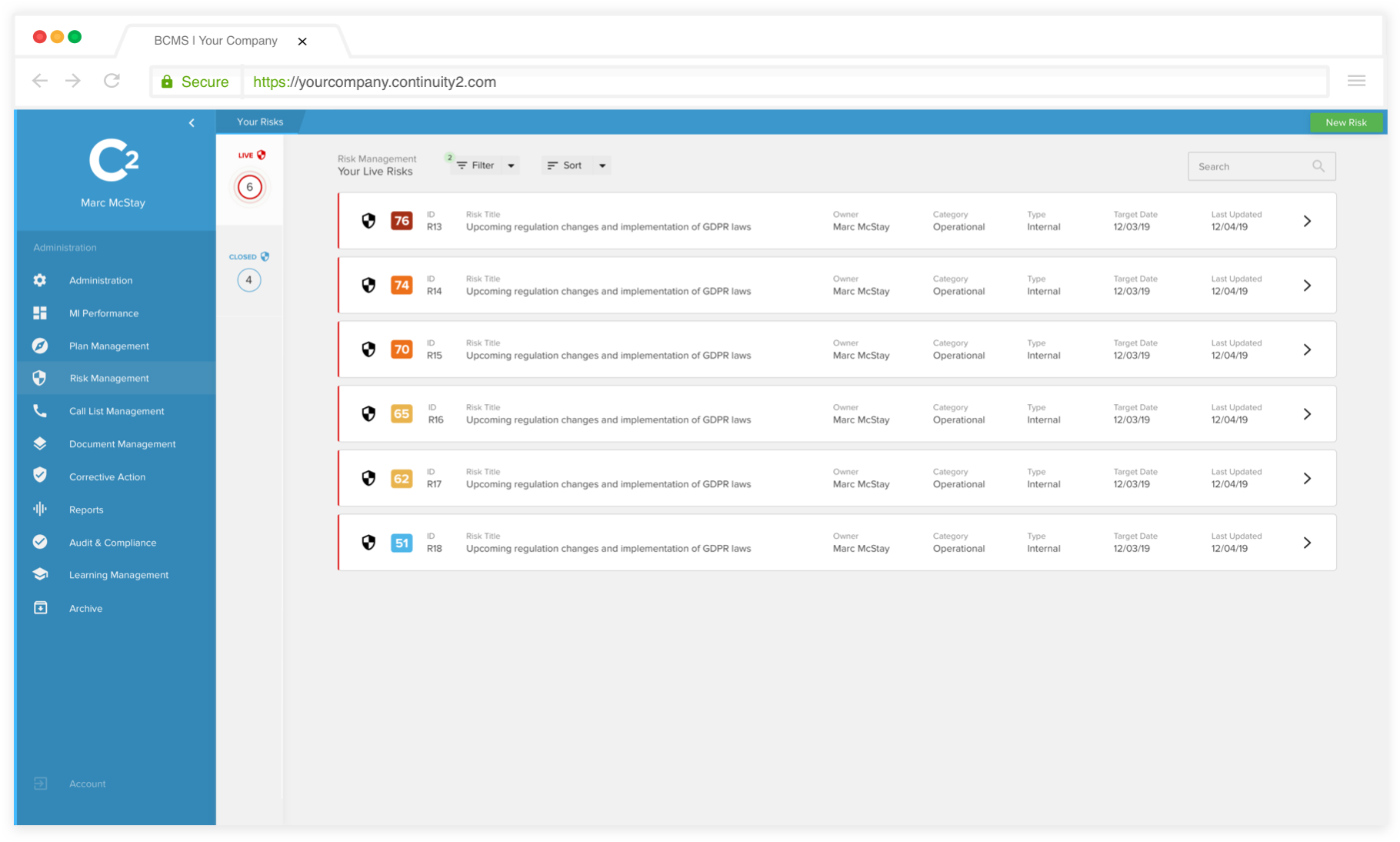

Risk

ManagementStreamline your risk assessments with our fully integrated RMS.

Find out more -

Operational Resilience

Smart automation for Operational Resilience framework.

Find out more -

Exercise & Testing

Carry out drills and exercises from start to finish.

Find out more -

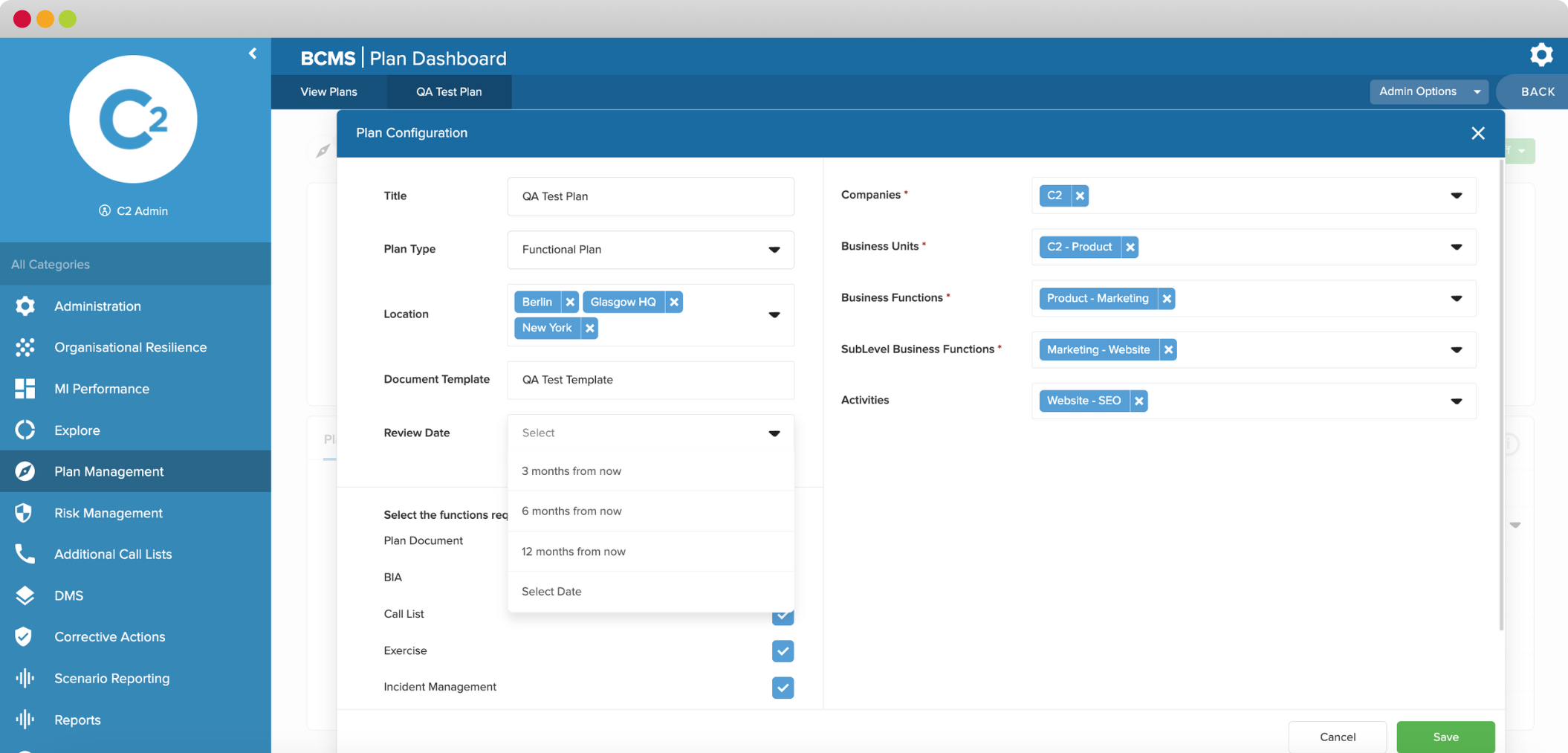

Corrective

ActionFully functioning corrective action tracking system.

Find out more -

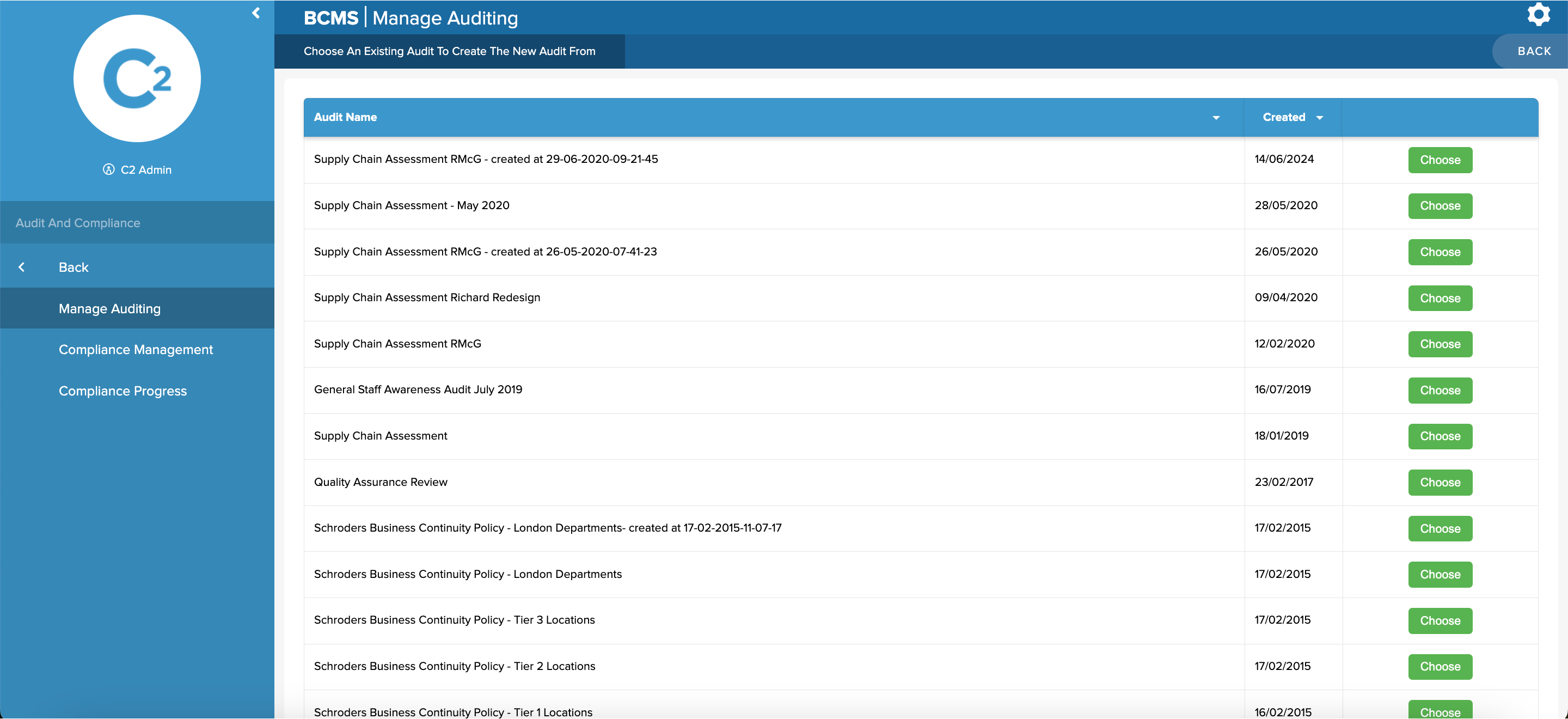

Audit & Compliance Management

Conduct internal audits with minimal effort.

Find out more -

Document

ManagementManage all documents with smart reminders and version control.

Find out more -

Policy Management

Manage your BC plans based on policy and KPIs.

Find out more -

Incident Management

Create and track incidents with real-time updates and native mobile app.

Find out more -

IT Disaster recovery

Automate your IT DR plans based on priority.

Find out more

The implementation process was good, transfer from legacy system to Meridian was smooth. The quality of service provided by the C2 support team was excellent, always available to help. We Have used C2 for over 5 years, and always keeps us ahead of regulations and expectations of Management. The ROI has been great with everything required for ISO 22301:2019 certification.

- Business Continuity and Incident Officer in Financial Services

Trusted by organisations across the world for the last 20 years and counting

Why Choose C2 Meridian Software?

-

State-Of-The-Art Security

Choices of user authentication solutions, e.g. MFA and SSO.

-

FCA/PRA Compliance

A complete software solution to satisfy the regulations

-

ISO Accredited

Aligned to international best practices. ISO 22301:2012 & ISO 22317:2015

Don't just take our word for it.

Business Continuity Solutions Provider for Organisations Worldwide

Paul G.

BCRM Manager

Helen T.

Business Continuity Manager

Rohan V.

Fraud Prevention

Paul G.

BCRM Manager

Helen T.

Business Continuity Manager

Rohan V.

Fraud Prevention

Paul G.

BCRM Manager

Helen T.

Business Continuity Manager

Rohan V.

Fraud Prevention

Go Ahead, See What C2 Can Do!

Access a

Demo

-

1

Tell us about you.

From the number of plans you're looking to manage to the specific functionality that your business needs. The more we know, the more we will make BC easy and effective to implement. -

2

See Continuity2 in action.

Our experts will demonstrate how our BCMS will streamline your processes and achieve resilience. You will see a product walkthrough, hear case studies, success stories, and ask questions! -

3

Implement it your way.

Our BC experts tailor your implementation based on your specific requirements, working closely with you every step of the way.

FAQs

Got a question? Send us your query and we will get back to you as soon as possible