Jump to a section

Now more than ever, risk management stands as an indispensable pillar for organisational stability and growth. The year 2025 has witnessed significant shifts in this domain, necessitating a fresh examination of its dynamics as we head into 2026.

Here, we will delve into the latest statistics and insights in risk management, offering a comprehensive overview of current trends and future projections across five overarching themes:

- Market Size and Growth of Risk Management

- Environmental and Geopolitical Risks

- Cybersecurity and Technology Risks

- Organisational and Economic Challenges

- The Future of Risks: Now and 2034

Global Risk Scenarios 2026

Experts at the World Economic Forum and Kearney have identified four plausible global outlooks that could bring significant risks and disruptions if they were to unfold. Driven by geopolitical fragmentation and global economic convergence, these outlooks aim to create an understanding of the planning required to minimise further issues.

- Reformed Outlook: A rules-based order emerges as nations engage with one another through trusted institutions. Nations actively choose to pursue cooperation in key areas like climate and trade to restore and promote stability.

- Fragmented Outlook: Even with geopolitical divides in place, nations choose to pursue economic deals. Partnerships focus on advantage, not alignment.

- Volatile Outlook: Institutions push for stability, but volatility and low trust hinder progress among nations. They choose to retreat from cooperative economic frameworks as trade reversals arise and policy uncertainty disrupts markets.

- Degraded Outlook: Nations prioritise control and security over economic efficiency and cooperation, undermining global governance.

Market Size and Growth of Risk Management

- The global risk management market size is expected to reach USD 35.9 Billion by 2032, exhibiting a growth rate (CAGR) of 13% during 2024-2032. (IMARC Group)

- The risk management software market was valued at USD 31.33 billion in 2021 and is expected to reach the value of USD 35.01 billion by 2029, at a CAGR of 9.75% during the forecast period. (Data Bridge Market Research)

- 71% of organisations carry out due diligence on suppliers' security, health and wellbeing standards and the same proportion say they would cut ties with suppliers whose standards don't meet the mark. (International SOS)

Environmental and Geopolitical Risks

- At 47%, geopolitical tensions are the top perceived drivers of risk and uncertainty that risk professionals report will have a significant impact on the global risk landscape. This is followed by cyber crime (27%) and jointly political instability, and economic instability and trade disruption (26%). (International SOS)

- 49% of risk and security specialists say the interconnectedness and convergence of risks have increased across the past 12 months. (International SOS)

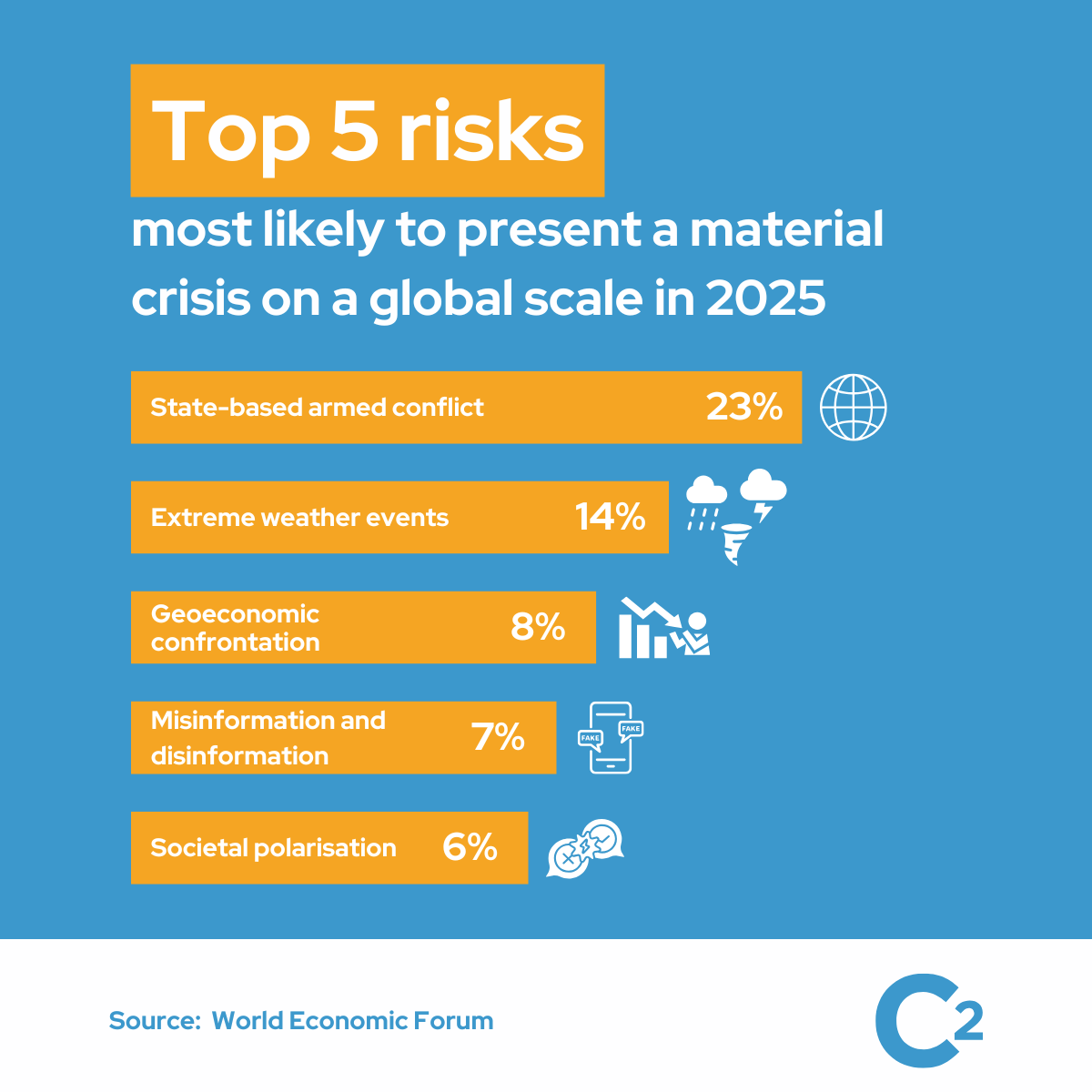

- 23% of World Economic Forum's Global Risks Landscape Survey respondents ranked state-based armed conflict as the top risk most likely to present a material crisis on a global scale in 2025. This is followed by extreme weather events (14%) and geoeconomic confrontation (8%). (World Economic Forum)

Cybersecurity and Technology Risks

- 86% of business leaders believe global political instability is likely to lead to a catastrophic cyber event in the next two years. (Accenture)

- The US government's Cyber Intelligence Threat Integration Center tracked over 2,500 ransomware attacks worldwide in 2024, up 15% on 2023. (International SOS)

- Only 6% of experts currently rank AI as an important factor in helping them manage risk. (International SOS)

- 66% of risk professionals say they believe uncertainty has been an increasingly prominent feature of their risk landscape in the past 12 months. (International SOS)

- A rise in AI-driven deepfake attacks resulted in a 53% increase in social-engineering incidents year-over-year, with social engineering and fraud claims also increasing by 233%. (Aon)

- 25% of CEOs cite cybercrime as top three risk compared to 19% in 2024. (BDO)

- 61% of risk professionals are most concerned by data breaches as a cyber exposure in their company. (Allianz Risk Barometer)

- Many professionals believe that AI will have a significant impact on their business over the next 12 months across several areas: cybersecurity (55%), compliance (52%, and supply chain (50%). (BDO)

- 62% of experts say that AI could increase privacy risks while 56% believe it could increase cybersecurity risks. (BDO)

- The average annual cost of an insider risk is USD 16.2 million. (DTEX)

- Organisations that took more than 91 days to respond to an insider incident had costs exceeding USD 18.3 million. (DTEX)

- 77% of organisations have started or are planning to start an insider risk management. (DTEX)

- 9 in 10 executives identify "cyber threats" as a long-term Top 5 risk. (Protiviti)

Organisational and Economic Challenges

- 57% of responders to International SOS's Risk Outlook 2026 survey said new risks are emerging faster than they can be dealt with. (International SOS)

- 80% of responders also said that the ability to detect risks more quickly would give them a competitive advantage. (International SOS)

- 74% of security and health specialists say the timescale for making critical risk decisions is tightening, but onle 35% are confident they can mobilise teams rapidly during a crisis. (International SOS)

- 74% of executives say embedding risk thinking into their business culture is a top priority. (BDO)

- 63% of CEOs and managing directors said regulatory risk is one of the top risks they are unprepared for, but 60% have also said that compliance overspend is a major problem. (BDO)

- 58% of leaders flag "economic conditions" as a top risk in 2024. (Protiviti)

- 61% of leaders identify "attracting and retaining talent" as a top risk in 2034. (Protiviti)

The Future of Risks: Now and 2034

As risk management involves forward-looking strategies and proactive measures to protect a business, part of this process often includes considering various forecasts that can impact the business environment.

We found some really interesting lists of top risks in 2024 and 2034 published by Protiviti. And here's what we think:

- Cyber threats remain a top concern in both 2024 and 2034. This indicates an ongoing struggle with cybersecurity challenges, likely driven by the continuous evolution of technology and the increasing sophistication of cyber attacks.

- The need to attract, develop, and retain top talent – while managing shifts in labour expectations – appears to be a consistent issue across the decade. This reflects the enduring importance of human capital in business success and the evolving expectations and needs of the workforce.

- The adoption of digital technologies requiring new skills appears in both 2024 and 2034, suggesting a long-term challenge in bridging the skills gap. This could point to the rapid pace of technological advancements outstripping the ability of the workforce to adapt.

- The challenge of existing operations and legacy IT infrastructure remaining competitive appears in both lists, pointing to a long-term issue with keeping up-to-date with technological advancements and the continuous pressure from "born digital" competitors.

- In 2034, the rapid speed of disruptive innovations enabled by new and emerging technologies is expected, which is not present in 2024. This anticipation of significant technological breakthroughs and market shifts in the next decade emphasises the need for agility and innovation in business strategies.

- The inability to utilise rigorous data analytics for market intelligence and efficiency appears as a new risk in 2034. This reflects the growing importance of data-driven decision-making and the potential consequences of failing to leverage data analytics effectively.

- As we head towards 2034, new threats will inevitably arise. The top long-term risks cited as the three most important to organisations are customers and competition (42%), security and privacy (40%), and AI deployments (39%).

- Emerging and peripheral risks require a degree of strategic foresight and agility as their relevance and potential impact is clarified. The unprepared will be too late to mitigate their impact.

Safeguarding Your Business With C2 Risk Management Tool

As businesses navigate through a maze of environmental concerns, economic uncertainties, technological advancements, and regulatory changes, understanding the key facets of risk management becomes crucial.

Our Risk Management module combines cutting-edge technology with an intuitive user experience to provide a complete solution to your risk needs. The risk framework is completely configurable to your organisation's requirements. Through administration, you can create custom risk types, risk categories, and risk treatments. When it comes to measuring/scoring your risk, you can also set custom impact and probability levels (applying your own weighting) and your very own formula for scoring risks. Our system also allows you to build in on-screen help to aid users with their assessments, making the risk assessment process extremely simple.

The system allows you to attribute risks to any part of your organisation and view your risks at any level, with all risks being aggregated into a company-wide register. Risk registers can be created for any level of your organisation, locations, or by any risk attribute, e.g. by risk category or score.

Our risk module integrates completely with C2 Meridian BCMS, allowing you to raise risks from any other system module, including directly from the Business Impact Analysis (BIA). With smart automation, risks can be automatically raised when certain events breach your risk tolerance, saving you time and reducing human error. All of your risk data is available in our Dynamic Reporting tool, meaning you can create custom risk reports to suit your needs and easily export your risk registers at the click of a button.

For a complete look at what our Risk Management tool can do for your organisation, book a demo today.

Frequently Asked Questions About Risk Management (Risk Management FAQs)

1. What is risk management?

Risk management involves identifying, assessing, and controlling threats to an organisation's capital and earnings. These risks stem from various sources, including but not limited to financial uncertainties, legal liabilities, strategic management errors, accidents, and natural disasters.

2. Why is risk management important?

Risk management is crucial as it helps organisations understand, manage, and mitigate risks, ensuring stability and profitability. It prevents losses, enhances decision-making, and supports compliance with laws and regulations.

3. What is a risk management plan?

A risk management plan is a document that details an organisation's strategy for identifying and addressing potential risks to minimise their impact on operations.

4. What is third-party risk management?

Third-party risk management involves identifying and managing risks associated with external entities, like vendors or partners, that a company interacts with. This ensures the third parties' actions do not adversely affect the company.

5. What is risk treatment?

Risk treatment involves selecting and implementing measures to modify risk. This includes risk avoidance, reduction, sharing, and retention strategies to manage and mitigate the potential impacts of identified risks.

Written by Donna Maclellan

Lead Risk and Resilience Analyst at Continuity2

With a first-class honours degree in Risk Management from Glasgow Caledonian University, Donna has adopted a proactive approach to problem-solving to help safeguard clients' best interests for over 5 years. From identifying potential risks to implementing appropriate management measures, Donna ensures clients can recover and thrive in the face of challenges.

Written by Donna Maclellan

Lead Risk and Resilience Analyst at Continuity2

With a first-class honours degree in Risk Management from Glasgow Caledonian University, Donna has adopted a proactive approach to problem-solving to help safeguard clients' best interests for over 5 years. From identifying potential risks to implementing appropriate management measures, Donna ensures clients can recover and thrive in the face of challenges.