Jump to a section

Governance, risk, and compliance (GRC) software has become indispensable for businesses aiming to stay ahead of regulatory challenges and operational risks.

GRC tools are critical for companies in rapidly changing regulatory environments, such as those in the financial, energy, and telecommunications sectors. GRC tools help ensure compliance, manage risk, improve decision-making, and maintain a competitive edge by enabling a proactive and strategic approach to governance, risk management, access governance, and compliance.

In this article, we will look at what GRC software really is for and explore some of the best options in the market. We will evaluate their features, usability, and how they stand out in facilitating a robust GRC framework.

Top 14 GRC Software for 2026

1. Ansarada GRC

2. Camms

3. Corporater

4. Diligent One Platform

5. IBM OpenPages

6. MetricStream

7. Mitratech Alyne

8. SAI360

9. SAP

10. ServiceNow

11. Soterion

12. StandardFusion

13. SureCloud

14. ZenGRC from Reciprocity

Is only GRC software enough for your business?

What is GRC software?

GRC software, standing for Governance, Risk Management, and Compliance software, is a type of business software designed to help organisations manage their overall governance, manage and assess risks systematically, and ensure that they are complying with regulatory requirements and internal policies. It integrates these critical functions into a cohesive framework to enable better strategic decision-making and operational efficiency, supported by centralized data for comprehensive analysis and reporting.

Here is a breakdown of the three core components it covers:

1. Governance – This refers to the processes and policies that ensure an organisation is managed effectively and ethically. Governance in GRC software helps align business processes and strategies with the company's goals, ensuring that management activities are transparent and accountable.

2. Risk Management – This aspect of GRC software assists organisations in identifying, assessing, and mitigating risks that could impede their objectives. It encompasses a wide range of risks, including financial, operational, IT, brand, and reputation risks. Effective risk management involves continuously monitoring potential risks and implementing strategies to address them, aiming to minimise negative impacts on the organisation.

3. Compliance – Compliance management in GRC software focuses on ensuring that an organisation adheres to external regulatory requirements and internal policies. This includes a.) tracking changes in relevant laws and regulations, b.) assessing compliance levels, and c.) managing documentation and reports required for regulatory audits and inspections.

GRC software offers a centralised platform for managing governance, risk, and compliance activities, making it easier to get an overview and detailed reporting on these aspects. Indeed, organisations that implement centralised data governance also stand to save the most, as they could reduce their compliance costs by $3 million.

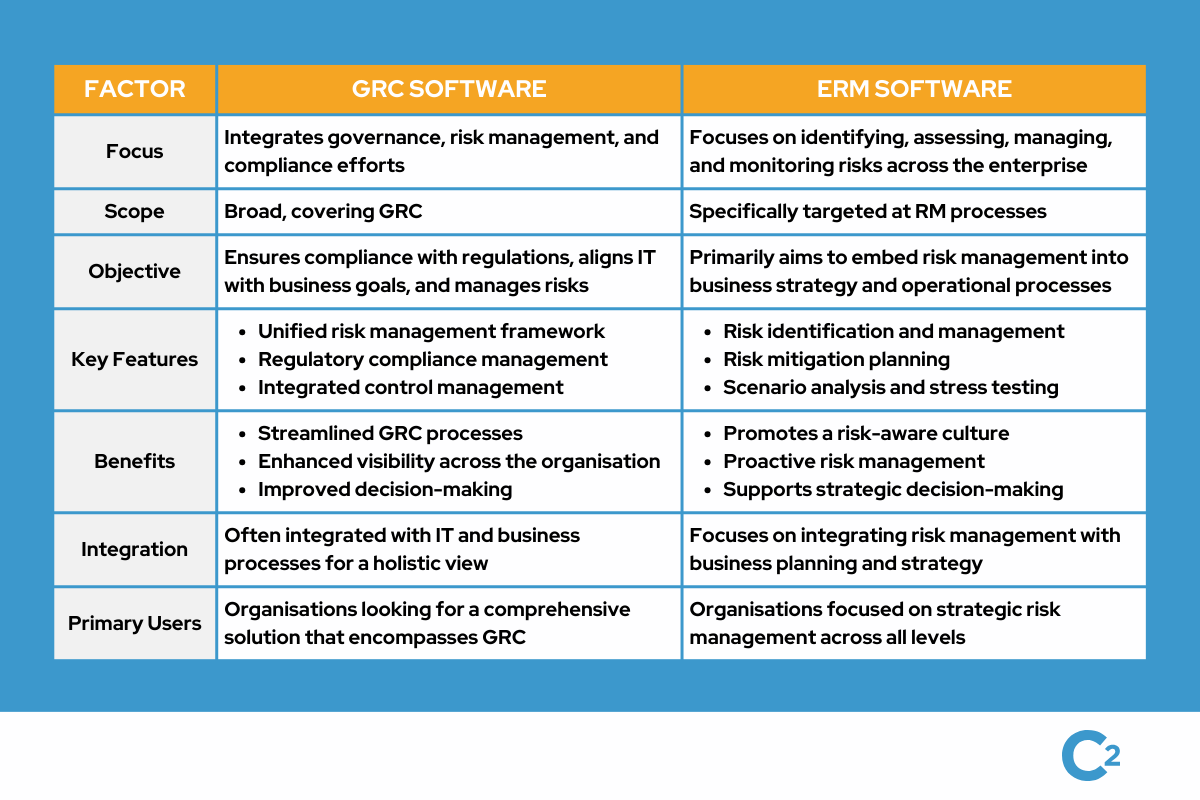

GRC Software vs ERM Software

GRC software and Enterprise Risk Management (ERM) software are tools used by organisations to manage risk and ensure compliance with legal and regulatory requirements. While both types of software aim to mitigate risk and enhance decision-making processes, they focus on different aspects of risk management and governance. Here are some of their key differences.

GRC software is more suited for organisations looking for a comprehensive solution that encompasses governance, risk management, and compliance. ERM software, on the other hand, is ideal for those primarily focusing on embedding risk management into their strategic planning and operational processes.

Key considerations in selecting GRC software

Apart from the immediate factors you would naturally take into consideration when purchasing software (e.g. user interface, scalability, customisation, and integration capabilities), you need to ensure the software truly meets your organisational needs and aligns with your company’s long-term goals. The last thing you need is another software that doesn’t yield ROI because nobody makes use of it. Ask yourself:

Does the software really support your organisation’s GRC efforts?

The GRC software should support your organisation’s specific governance, risk, and compliance goals and objectives. It should enhance, not hinder, your ability to conduct business effectively.

What is the software’s adaptability to regulatory changes?

Your GRC software of choice should help manage and streamline compliance processes, track changes in laws and regulations, and ensure that compliance tasks are completed on time. It should support compliance with relevant industry standards and regulations.

What reporting and analytics capabilities does the software offer?

Last but not least, effective reporting tools and dashboards are essential for monitoring GRC activities and providing insights into governance, risk, and compliance status. Customisable reports and real-time data visualisation can help stakeholders make informed decisions. The software should also support continuous monitoring to provide real-time insights into compliance and risk management activities.

Key features to look for in GRC software

The features you look for in GRC software may vary depending on the specific needs and priorities of your organisation. However, certain features are universally recognised as critical by GRC professionals for effectively managing GRC processes.

- Unified Risk Management Framework: Your GRC software should serve as a centralised platform for managing all types of risks across the organisation, including strategic, operational, financial, and IT risks. This allows a consistent approach to risk assessment, mitigation, and monitoring. A unified framework ensures that risk management efforts are aligned with your organisation's strategic objectives and, respectively, enhances decision-making and operational resilience.

- Regulatory Compliance Management: Given the ever-changing regulatory landscape, your GRC tools should be able to help you track changes in laws and regulations, manage compliance documentation, and ensure that organisational policies and procedures are updated accordingly. This helps in avoiding fines and penalties, protecting the organisation's reputation, and ensuring legal and regulatory compliance.

- Integrated Control Management: Effective management and monitoring of internal controls are essential for mitigating risks and ensuring compliance. This allows organisations to integrate controls seamlessly into their business processes to ensure that control activities are effectively aligned with risk and compliance requirements. It also facilitates the identification of control gaps and the implementation of corrective actions.

- Comprehensive Reporting and Dashboards: Your GRC software should allow access to real-time data and analytics through customisable reports and dashboards. This feature provides insights into your organisation's risk posture, compliance status, and the effectiveness of your GRC strategies. It supports informed decision-making and enables your GRC professionals to communicate risk and compliance information effectively to stakeholders.

- Audit Management: This feature supports the entire audit lifecycle, from planning and scheduling to execution and reporting. Effective audit management tools are critical for identifying and addressing compliance issues, inefficiencies, or areas of risk. It enables organisations to manage internal and external audits efficiently, track audit findings, and ensure timely implementation of recommendations.

Top 14 Governance, Risk, and Compliance Software

Each GRC platform brings something unique to the table, whether that be an industry-specific functionality or advanced scalability. Remember, it is the specific needs, size, and industry of your organisation that dictate the best fit. Here are, in alphabetical order, the 14 best GRC solutions for 2026.

1. Ansarada GRC

Ansarada GRC stands out for its AI-driven insights and data rooms that enhance deal-making and risk management. Its unique approach to GRC is tailored towards mergers, acquisitions, and corporate governance, making it ideal for businesses looking to streamline complex transactions and compliance requirements. Its AI-driven insights also enhance data collection processes, enabling more accurate and timely risk assessments. However, companies outside of these specific scenarios may find its specialised features less applicable to their day-to-day GRC needs.

2. Camms

Camms specialises in providing a user-friendly interface and comprehensive risk management solutions. What sets Camms apart is its strong focus on strategy, performance, and project management within the GRC context, integrating these elements to foster informed decision-making and organisational efficiency. While this holistic approach facilitates informed decision-making and efficiency, organisations looking for a more traditional, risk-focused GRC platform might find it a bit off the mark. This holistic approach makes Camms a versatile choice for enterprises looking to integrate strategy and performance management with their GRC efforts.

3. Corporater

Corporater distinguishes itself with a highly customisable GRC platform that integrates business management frameworks, including Balanced Scorecard. Corporater's ability to adapt to a wide array of business models and operational needs makes it a versatile choice for organisations seeking a tailored GRC solution. Yet, the steep learning curve associated with customisation can be daunting for teams without dedicated IT support.

4. Diligent One Platform

Diligent emphasises secure governance and collaboration tools. This GRC platform stands out for its comprehensive suite that spans governance, risk, compliance, and ESG standards, offering a holistic approach to corporate governance. Diligent also excels in supporting ESG programs, helping organizations enhance their sustainability and governance practices. Diligent is a robust choice for boards and senior executives, though the breadth and depth of its offerings can be overwhelming for smaller organisations or those with more focused needs.

5. IBM OpenPages

IBM OpenPages leverages IBM’s cutting-edge AI technology to offer a platform with robust analytics and cognitive capabilities. Thanks to its scalability and flexibility, IBM OpenPages is no doubt a powerful tool for managing risk and compliance for diverse industries and regulatory environments. However, the complexity and cost associated with such an advanced system may pose challenges for smaller businesses. Its advanced capabilities also extend to event management, helping organizations identify and respond to security threats effectively.

6. MetricStream

MetricStream excels in offering a broad, integrated GRC platform that covers everything from compliance and risk management to audit and policy management. MetricStream‘s comprehensive content library and industry benchmarking capabilities help businesses stay ahead in compliance. Yet the platform’s extensive feature set might introduce a complexity that requires a robust training program for users. MetricStream's extensive feature set makes it a powerful GRC tool for organizations looking to stay ahead in compliance and risk management.

7. Mitratech Alyne

Mitratech Alyne delivers a tech-forward approach focusing on cybersecurity and regulatory compliance, enriched with a comprehensive risk library and AI-driven analytics. While its modern approach is commendable, businesses with established GRC processes might find integration with existing systems somewhat challenging.

8. SAI360

SAI360 offers flexibility and a user-friendly platform that does not skimp on a comprehensive GRC toolkit, including health, safety, and environmental (HSE) management. However, companies that do not need the extensive HSE features may find themselves navigating unnecessary complexity. SAI360's integrated suite of tools ensures that all aspects of governance, risk, and compliance are managed effectively.

9. SAP

SAP integrates GRC solutions with its ERP systems. It offers deep business process integration for real-time insights and controls. This seamless integration is a double-edged sword, as it may lock businesses into the SAP ecosystem, limiting flexibility with third-party solutions. This integration allows businesses to monitor risks in real-time, ensuring that they can respond to potential issues promptly.

10. ServiceNow

ServiceNow brings a unique IT and service management background to GRC, focusing on automating governance, risk, and compliance processes. This GRC platform excels in incident response and business continuity planning, leveraging the power of IT workflows to enhance risk management. However, organisations with less focus on IT may not fully benefit from its specialised capabilities. By leveraging IT workflows, ServiceNow helps organizations make more informed decisions regarding risk and compliance.

11. Soterion

Soterion focuses on SAP security and GRC. It offers targeted solutions for access risk, compliance, and data privacy within SAP environments. While its niche approach is perfect for SAP-reliant companies, those using diverse systems might find Soterion’s offerings too limiting. Soterion's targeted solutions also help organizations manage operational risk within SAP environments.

12. StandardFusion

StandardFusion is designed with a focus on simplicity and usability, aiming to demystify GRC for small to medium-sized businesses. This platform stands out for its ability to manage compliance, risk, and information security in a straightforward and accessible manner. StandardFusion is an excellent entry point for companies making their first foray into GRC, though larger organisations or those with complex regulatory needs may outgrow its capabilities. StandardFusion's user-friendly interface is complemented by predictive analytics that enhance risk management and decision-making.

13. SureCloud

SureCloud differentiates itself with its flexibility and cloud-based platform. It supports a wide range of GRC applications, including risk management, compliance, information security, and incident management. Its strength lies in providing a scalable and customisable solution that grows with the organisation. Still, the potential need for ongoing adjustments and configurations can demand a continuous investment of time and resources. SureCloud's platform also features real-time dashboards that provide instant insights into risk and compliance activities.

14. ZenGRC from Reciprocity

ZenGRC focuses on making GRC as efficient as possible through simplicity and automation. This platform is known for its user-friendly interface and the ability to streamline compliance, risk management, and audit workflows, making GRC accessible for companies of all sizes. Some, however, may find the depth in certain risk or compliance areas a bit lacking compared to more specialised platforms. ZenGRC's streamlined workflows also enhance the efficiency of risk assessments, ensuring timely and accurate evaluations.

Is only GRC software enough for your business?

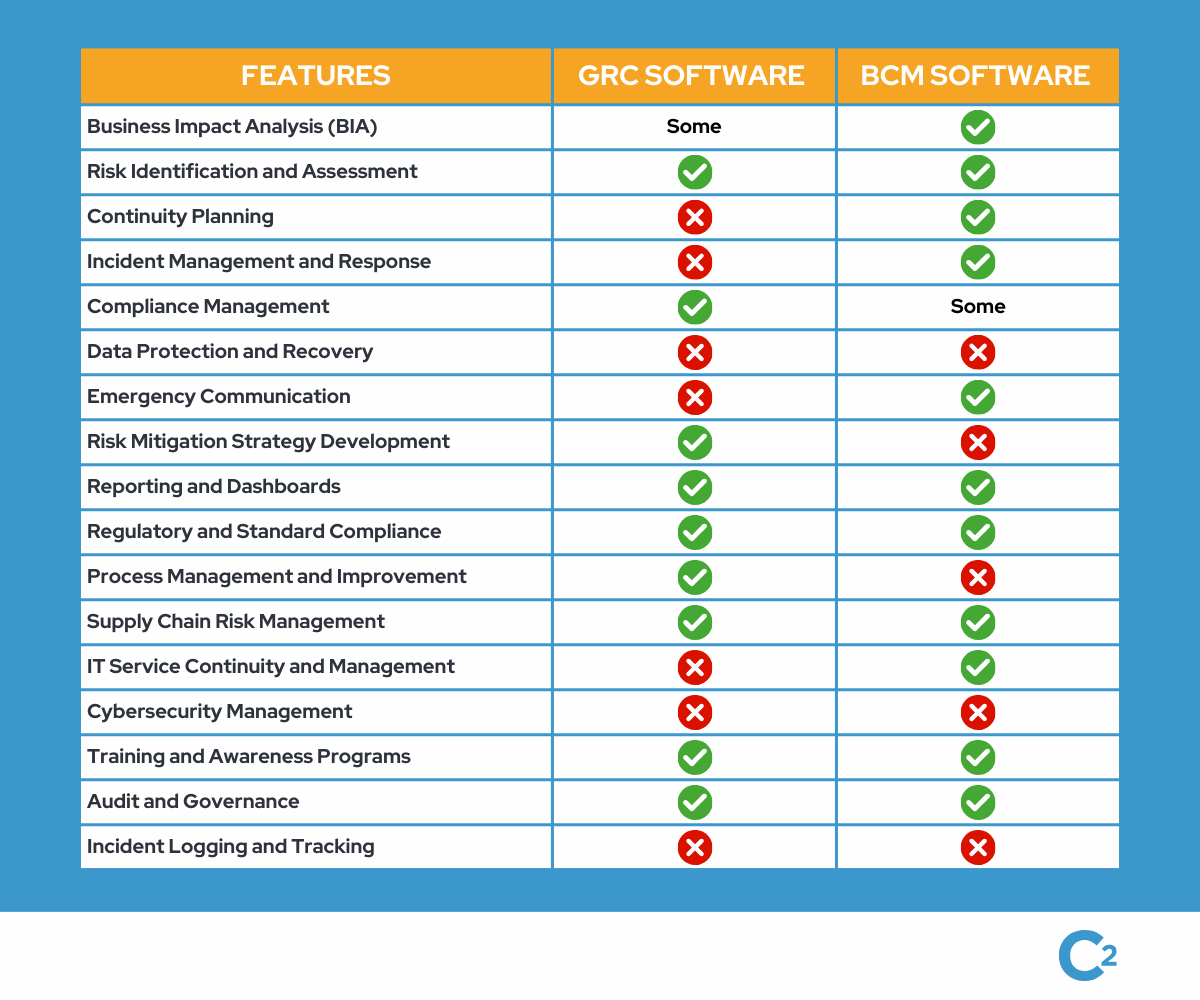

While GRC software helps identify and manage a broad range of risks, including compliance and operational risks, you should consider integrating business continuity management, which focuses on the risks associated with business interruptions and disasters.

BCM is centred around preparing for, responding to, and recovering from incidents that could disrupt business operations. By including business continuity in your GRC strategy, you ensure that your organisation is not only managing risks proactively but also prepared to maintain critical operations under adverse conditions. Integrating BCM with GRC software enhances risk awareness across the organization, ensuring that all potential threats are identified and managed proactively.

Some industries and regions even have specific regulations and standards that mandate business continuity planning. For example, financial institutions in the UK are monitored by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA).

A holistic approach that includes both GRC and BCM ensures that these regulatory requirements are met comprehensively, helping avoid penalties and reputational damage. It also provides leadership with a more detailed and comprehensive view of the organisation’s risk landscape, which ultimately supports better-informed decision-making and strategic planning.

Choosing C2 for your GRC efforts

C2 Meridian BCMS presents a comprehensive solution for achieving this integration, aligning perfectly with regulatory standards and improving decision-making processes during business disruptions.

Our industry-agnostic software facilitates a thorough Business Impact Analysis (BIA) so organisations can understand the criticality of various functions and processes. This helps ensure comprehensive risk management that covers both compliance and operational resilience.

C2 Meridian BCMS also offers dynamic reporting and real-time analysis capabilities, providing businesses insights into their risk posture and the effectiveness of their continuity strategies. This ensures leadership has a comprehensive view of the organisation’s resilience by consolidating risk data from various sources for better analysis and decision-making.

Incorporating BCM into your GRC strategy is not just a regulatory requirement but a strategic advantage. Our software equips organisations with the tools necessary to assess risks comprehensively, manage incidents effectively, and comply with specific industry regulations, all within a unified platform.

Book a demo today to see how our software not only supports regulatory compliance but also enhances operational resilience, positioning your business to thrive in today’s uncertain environment, or get in touch to find out how our experts can boost your internal operational resilience practices with their professional support.

Written by Richard McGlave

Founder & CEO at Continuity2

With over 30 years of experience as a Business Continuity and Resilience Practitioner, Richard knows the discipline like the back of his hand, and even helped standardise BS25999 and ISO 22301. Richard also specialises in the lean implementation of Business Continuity, IT Service Continuity and Security Management Systems for over 70 organisations worldwide.

Written by Richard McGlave

Founder & CEO at Continuity2

With over 30 years of experience as a Business Continuity and Resilience Practitioner, Richard knows the discipline like the back of his hand, and even helped standardise BS25999 and ISO 22301. Richard also specialises in the lean implementation of Business Continuity, IT Service Continuity and Security Management Systems for over 70 organisations worldwide.