Top 8 Vulnerability Management Tools

Explore the best VRM software to streamline due diligence, monitor vendors in real time, and support compliance, reporting, and business continuity.

Published on October 27, 2025

Last updated on November 27, 2025

Every organisation faces risks. Whether it’s financial, operational, strategic, or compliance-related, identifying and analysing these risks is central to maintaining business resilience. However, manual processes and fragmented spreadsheets no longer meet the needs of modern enterprises. This is where risk analysis software steps in — offering structured, data-driven insights to assess, monitor, and mitigate potential threats effectively.

Risk analysis software provides visibility into an organisation’s risk posture, enabling leadership teams to make informed, timely decisions. With automation, real-time reporting, and integrated workflows, these solutions simplify risk management while enhancing compliance and operational resilience. In this article, we’ll explore what risk analysis software is, its key features, and the leading platforms available today.

Risk analysis software helps organisations identify, evaluate, and prioritise risks that could impact their operations or objectives. It supports teams in quantifying both the likelihood and potential impact of identified risks, helping to inform mitigation and treatment strategies.

Unlike basic risk registers, risk analysis tools often include advanced capabilities such as predictive analytics, scenario modelling, and integrated reporting dashboards. They enable continuous monitoring and ensure alignment between risk tolerance levels and business goals. Ultimately, risk analysis software provides a clear view of emerging threats and empowers organisations to respond proactively rather than reactively.

While different tools may specialise in various types of risk, certain features are fundamental to any reliable risk analysis solution.

This feature enables users to capture, classify, and evaluate potential risks. Through built-in frameworks and scoring models, teams can assess the likelihood and severity of risks consistently.

Scenario modelling allows organisations to simulate possible outcomes and evaluate the potential financial or operational effects of risk events. This supports strategic decision-making and resilience planning.

Automated scoring systems assign numeric or qualitative ratings based on predefined parameters, eliminating subjectivity and ensuring consistency across risk assessments.

Customisable dashboards present risk data visually, offering real-time insights into risk trends, heat maps, and KPIs. Reporting tools enable users to generate tailored reports for boards, regulators, and auditors.

Risk analysis software should integrate with existing enterprise systems such as ERPs, CRMs, and project management platforms. This allows for the seamless exchange of risk data and promotes a unified view of risk exposure.

Built-in compliance management functions assist in tracking obligations, conducting audits, and maintaining documentation — crucial for regulated industries.

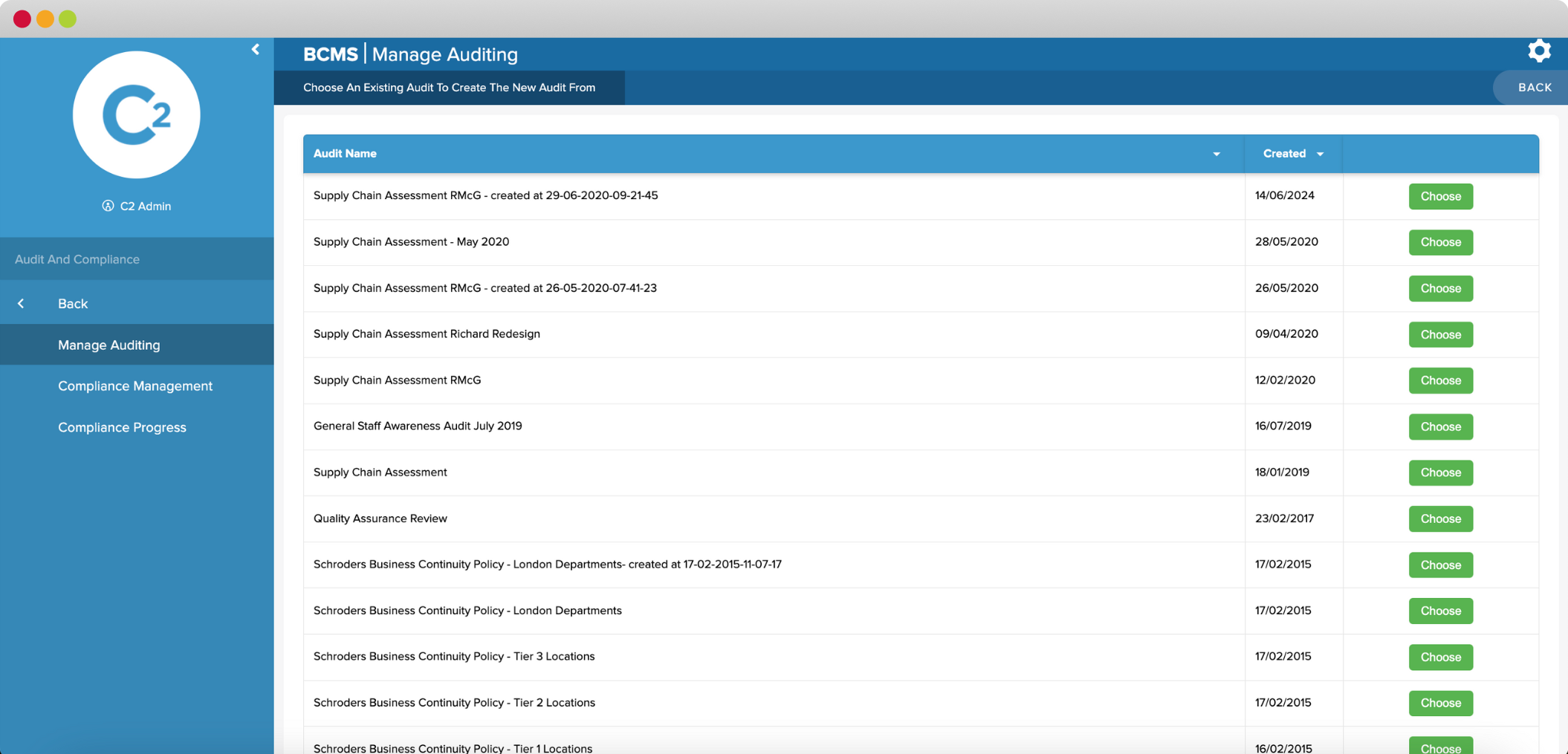

Continuity2 provides industry-leading solutions for business continuity, risk analysis, and operational resilience. Its comprehensive Meridian platform enables organisations to analyse, monitor, and manage risks through a single, intuitive interface. With customisable workflows, real-time reporting, and deep automation capabilities, Continuity2 supports proactive decision-making and compliance alignment across the enterprise.

Key Features:

Best for: Enterprises seeking an integrated platform that connects risk management with business continuity and operational resilience.

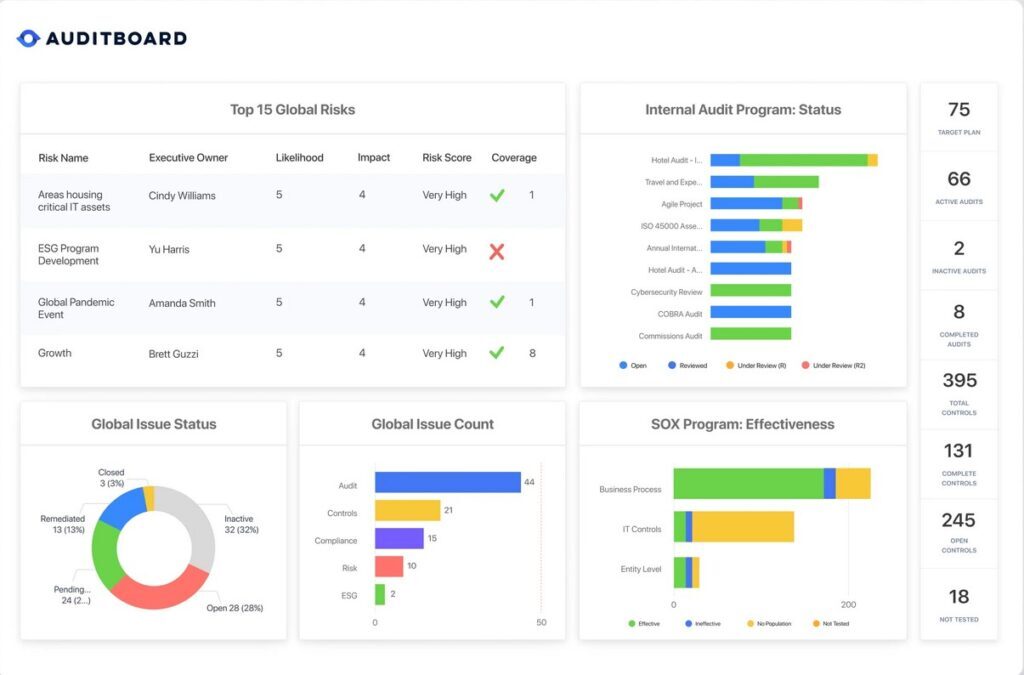

AuditBoard simplifies enterprise risk and compliance management with an integrated cloud platform. Designed for transparency and collaboration, it provides tools for assessing, analysing, and reporting on organisational risks.

Key Features:

Best for: Mid-to-large organisations looking to align risk, audit, and compliance within a unified platform.

LogicGate’s Risk Cloud delivers modular, no-code risk management capabilities. The platform’s flexibility allows teams to customise workflows and automate processes tailored to their needs.

Key Features:

Best for: Organisations seeking flexible, customisable risk workflows.

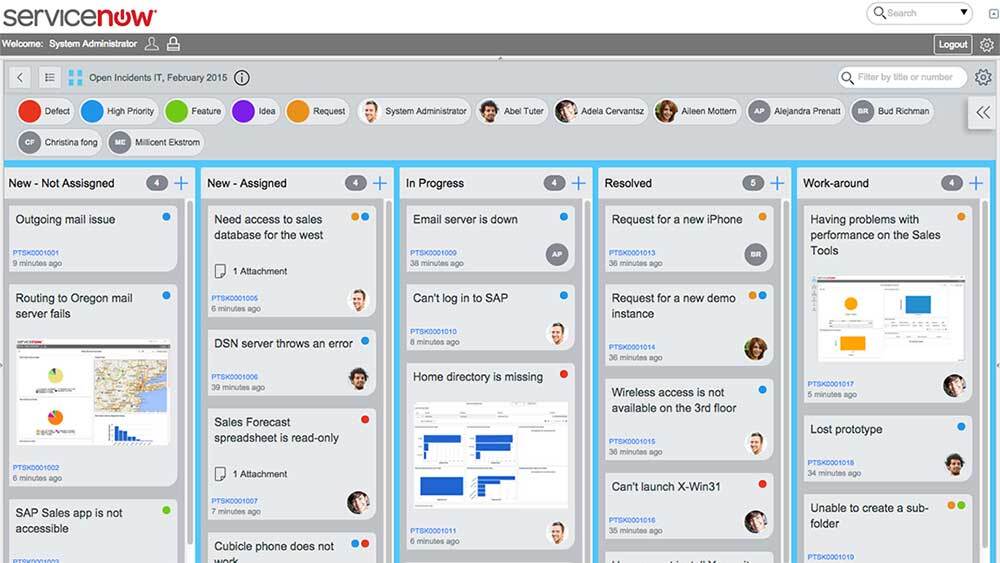

ServiceNow integrates risk analysis within its GRC suite, offering a centralised approach to managing enterprise risks, controls, and compliance.

Key Features:

Best for: Large enterprises aiming for end-to-end visibility across risk, compliance, and IT operations.

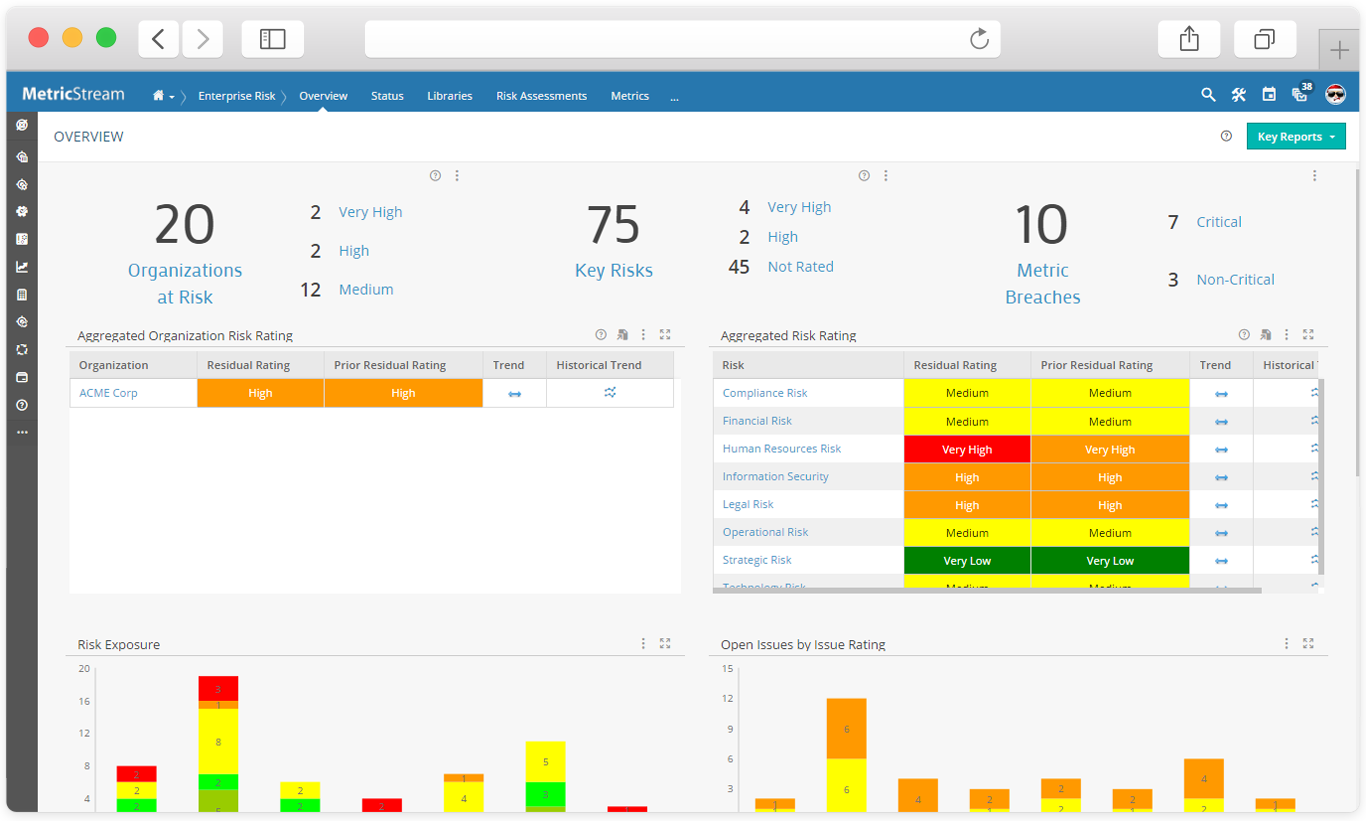

MetricStream offers comprehensive risk management with strong analytics and compliance features. It supports a unified view of enterprise-wide risks.

Key Features:

Best for: Global organisations managing complex, cross-functional risk environments.

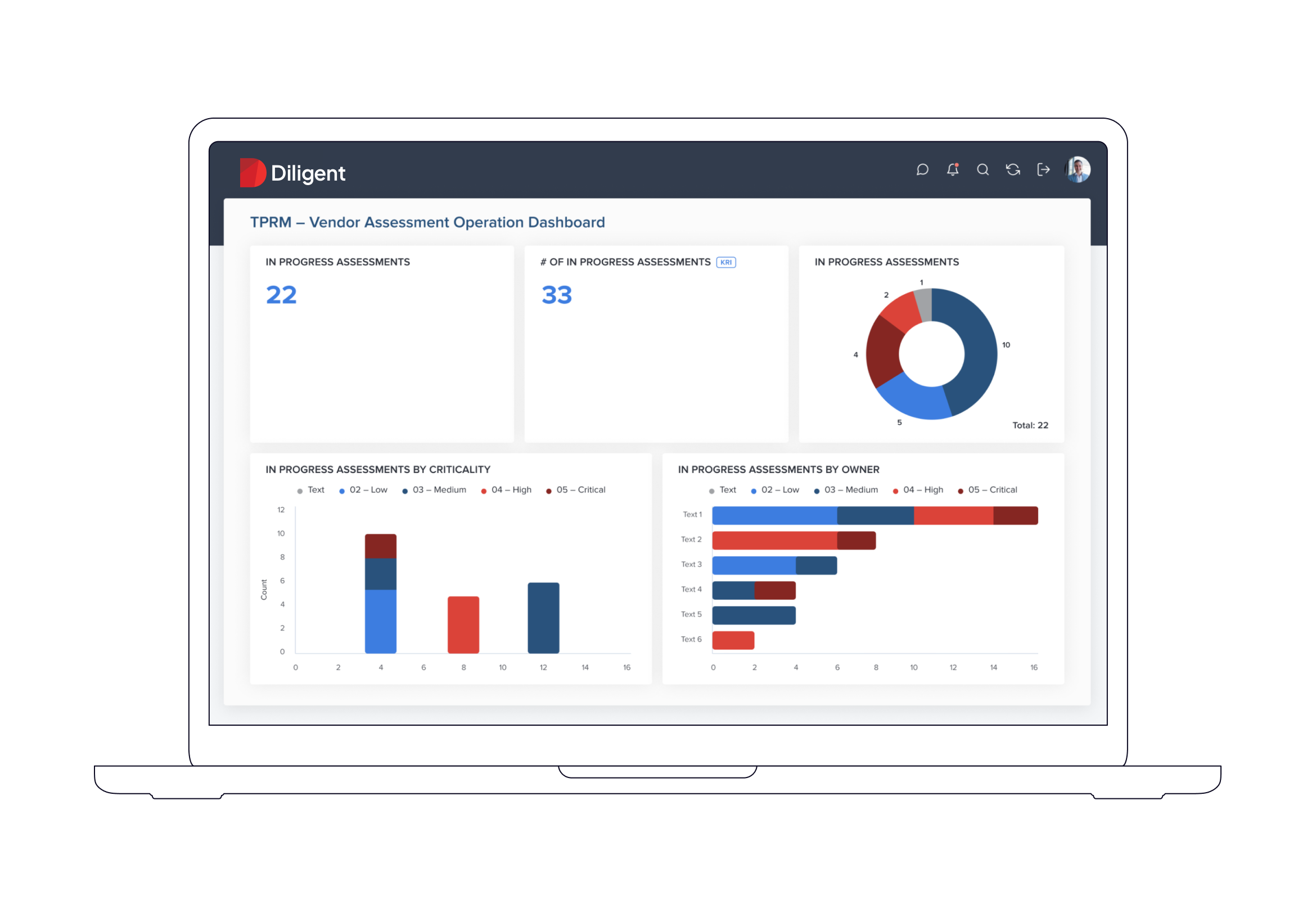

Diligent provides a modern risk and governance platform focused on accountability and transparency. It helps organisations understand and mitigate emerging risks with board-level visibility.

Key Features:

Best for: Boards and senior leaders requiring centralised oversight of risk performance.

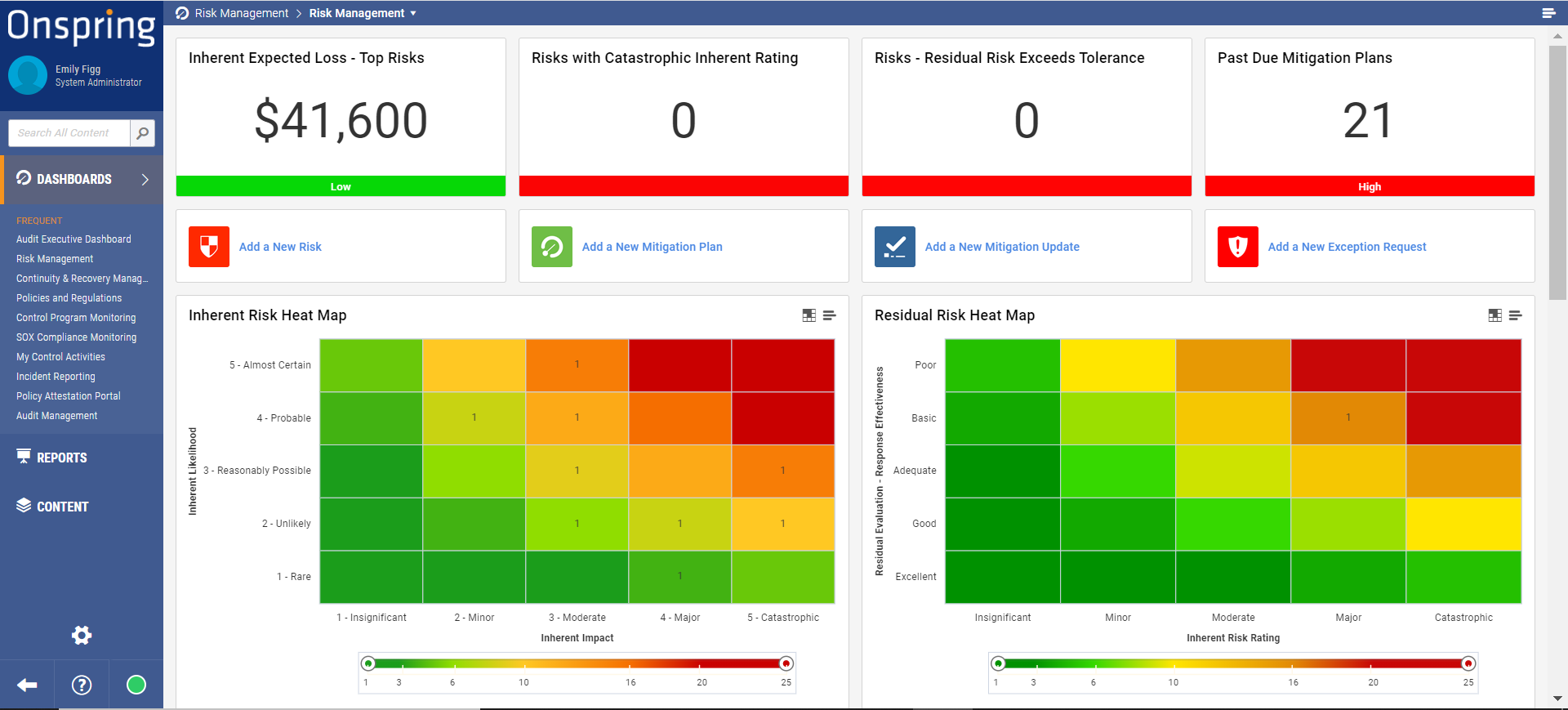

Onspring offers intuitive and adaptable GRC and risk analysis tools designed to enhance visibility across business units.

Key Features:

Best for: Medium-sized businesses wanting quick implementation and flexible integrations.

Risk management software empowers organisations to automate data collection, improve compliance, and strengthen resilience through faster, insight-driven decision-making.

Automated data collection and real-time analytics provide leadership with accurate insights to make confident, informed decisions. This transparency supports better prioritisation and resource allocation.

Centralised documentation and automated workflows make regulatory compliance easier to manage. Audit trails and version control ensure all risk activities are traceable and defensible.

Automation eliminates repetitive manual work, freeing teams to focus on higher-value analysis and mitigation activities. This reduces administrative overhead and increases productivity.

Continuous monitoring helps detect early warning signs, enabling prompt responses to potential disruptions. This supports operational resilience and business continuity.

Risk analysis tools are indispensable for modern organisations that prioritise resilience, transparency, and data-driven decision-making. With the right platform, risk management can evolve from a reactive process into a continuous, value-adding discipline.

Continuity2’s Meridian platform helps you connect business continuity, risk management, and resilience into one seamless system — enabling you to respond faster and more effectively to change.

Book a Demo with Continuity2 to learn how your organisation can transform its risk analysis and resilience strategy.

Founder & CEO at Continuity2

With over 30 years of experience as a Business Continuity and Resilience Practitioner, Richard knows the discipline like the back of his hand, and even helped standardise BS25999 and ISO 22301. Richard also specialises in the lean implementation of Business Continuity, IT Service Continuity and Security Management Systems for over 70 organisations worldwide.

Founder & CEO at Continuity2

With over 30 years of experience as a Business Continuity and Resilience Practitioner, Richard knows the discipline like the back of his hand, and even helped standardise BS25999 and ISO 22301. Richard also specialises in the lean implementation of Business Continuity, IT Service Continuity and Security Management Systems for over 70 organisations worldwide.

Explore the best VRM software to streamline due diligence, monitor vendors in real time, and support compliance, reporting, and business continuity.

Explore the best VRM software to streamline due diligence, monitor vendors in real time, and support compliance, reporting, and business continuity.

Discover the top 10 Threat Intelligence Platforms of 2026 to detect, analyse, and respond to cyber threats with greater speed and precision.

Explore the best third-party risk management software to automate vendor assessments, track compliance, and reduce exposure across your supply base.

Discover the top 7 Supply Chain Risk Management (SCRM) tools of 2026 to monitor suppliers, predict disruptions, and build supply chain resilience.

Find the best supply chain management software of 2026 and gain real-time visibility, streamline planning and logistics, and protect business continuity.

Compare the top supplier monitoring tools of 2026 and find the right software to enhance supplier visibility and protect your supply chain.

Find the best SIEM tools to detect threats faster, automate incident response, ensure compliance, and strengthen your organisation’s cyber resilience.

Discover top risk and resilience software for manufacturing in 2026—SOAR automation, visibility, and compliance to protect uptime and supply chains.