Jump to a section

Audits are required across many industries. While they are often attached to financial statements and spending, many other departments can benefit from creating an audit report. Many businesses can dislike the idea of conducting audits, but they are important exercises that deliver a multitude of benefits.

Audits can help to establish trust with external stakeholders and other important figures. Depending on the industry a business operates in, it may have to complete an audit to demonstrate compliance with the demands of a regulatory body.

Read on and learn more about audits and the different types a company may be required to complete.

What is an audit?

An audit is an examination of relevant internal data to determine whether the company is being truthful in its reports. This usually involves an examination of a company's financial records, but can also include an investigation into other documents or protocols if relevant.

Auditing standards for engagements within the public interest in the UK are written and maintained by the Financial Reporting Council (FRC).

Internal vs external audits

Audits can be conducted both internally and externally. While an internal audit may be sufficient for many, external audits can be required to corroborate findings or to meet a standard set by a regulatory body.

An internal audit is handled by an employee of the business. It is frequently requested by the CEO or business owner but will be handled by someone else. For example, a financial audit may be conducted by a CFO rather than a CEO.

An external audit is conducted by a third party who has no connection to the audited business (i.e. they are not and never have been an employee). Common third parties include accountants, but full standards for external auditors can be found in ISA (UK) 620. External audits are frequently used to ensure that all financial reporting from the business is indeed accurate and fair. If both an internal and external audit were to be completed, the final conclusion should be the same.

What are the benefits of conducting audits?

Audits can sometimes be looked at as unnecessary paperwork that clogs up resources and time that could best be spent looking at issues or tasks within the business. However, this simply isn't true. There are several benefits to conducting audits, and they are very important business processes that cannot be ignored. A thoroughly conducted audit can benefit you by:

Finding outdated processes

Businesses can become set in their ways and determined to keep things as they have always been. Unfortunately, in doing so they can become stagnant and no new development can take place.

When businesses commit to a process without any change, they will miss the opportunity to refine and better it. They may also become complacent, allowing issues to arise without realising, and this could lead to the creation of issues that would otherwise be avoided.

An audit can identify these stagnant and outdated processes and can help uncover the weaknesses allowed by complacency.

Catching issues early

The earlier an issue is discovered, the easier it will be to mitigate. Much of operational resilience is built around weathering any storm that could disrupt a business, but a resilience framework can only be created if employees are aware of the risks and issues that could affect them.

An audit can help to identify these key issues that could cause major issues. A Business Impact Analysis (BIA) is not the same as an audit, but the two can be used in conjunction to create a workable action plan that identifies risks and creates a pathway to avoid them.

Supporting better business decisions

Better business decisions can only be made when we are aware of the changes needed to bring about growth in the company. Rather than trying a tactic for the sake of doing something new, or hopping on the latest trend because we have seen it bring success to competitors, we need to ensure that we make targeted, informed decisions.

An audit can help to provide the data for these decisions, and additional audits and tests in the future can help to determine the success of the decision.

What are the most common types of audits?

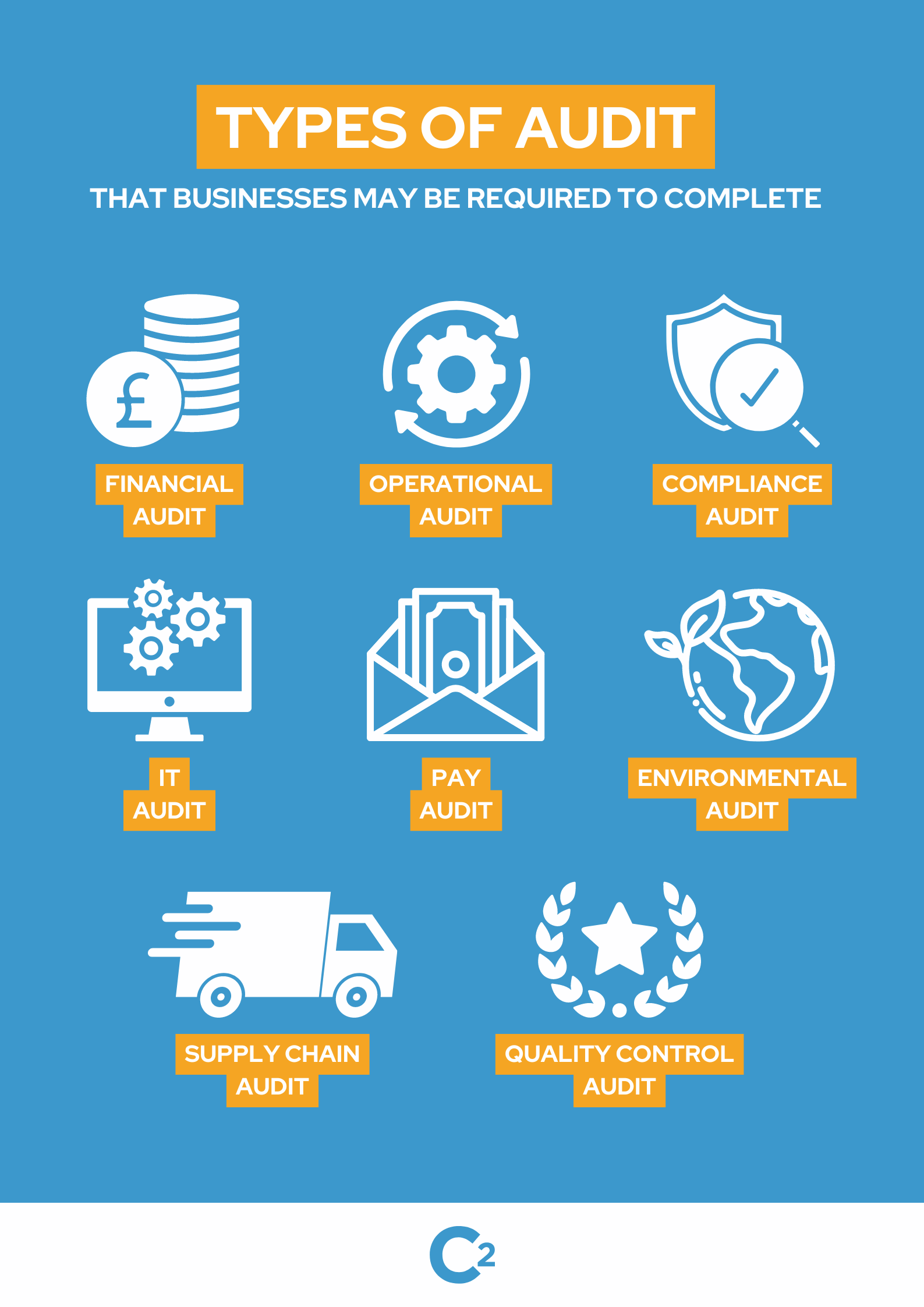

A typical business has too many processes to fully and accurately audit, so audit reports usually only focus on a few key areas. The most common types of audit a business undertakes are:

Financial audit

A financial audit is usually handled externally. The auditor will look at the business's financial reports to determine if statements reported to regulators are accurate. In the UK, these financial statements are typically reported to the FRC, Companies House, and HM Revenue and Customs (HMRC).

The auditor will typically examine all transactions, balances, and financial procedures in a financial audit. They will then construct a report based on their findings, which will be shared with the business and any other interested parties, such as investors or lenders.

Operational audit

An operational audit will usually be handled internally but can be given to an external auditor if there is a severe disruption or disconnect or simply because company leaders value unbiased insights.

Operational audits look at current operations and ways of working. They can identify inefficient practices or protocols and can then deliver recommendations for improvements.

Compliance audit

Many companies often come under regulatory scrutiny and must demonstrate an audit process to show that they do indeed meet the standards expected of them. These are often handled externally and may even be done by an agent of the regulatory body who fully understands what a compliance audit must look at. If current procedures do not meet expected standards, the company may be sanctioned or fined until they have made the necessary changes.

Compliance audits can also be held internally. Though these will focus on compliance issues, the exact issues may be very different. For example, a company may choose to enact an internal compliance audit to determine if frontline workers are following current Health & Safety regulations. Such an audit may be linked to a greater concern for the company at large, such as being taken to court for poor Health & Safety practices, but it is concerned with the knowledge of workers on an individual basis and the implications such deficiencies might bring.

What are some other audits a business might choose to run?

Financial, operational, and compliance audits are the most common that a business could choose to run, but they are also not the only options. Getting an audit opinion can help to identify many issues currently existing within a business. Whether a business chooses to get an expert in for assessment or decides that internal audits are sufficient, they may decide to look at the following areas:

IT audit

It is near-impossible nowadays to have a company and not use some form of information system or software to aid business. However, software and IT solutions can carry their own vulnerabilities, and companies must be aware of cyber attacks. The UK's National Cyber Security Centre's research discovered that 84% of businesses and 83% of charities had been subject to phishing attacks in 2023, among other alarming cybersecurity stats.

An information systems internal audit report can ensure that all systems used by the business are protecting private data as they should. Cybersecurity audits can also help to determine whether there are vulnerabilities in existing protections so they can be addressed before a real threat attacks.

Pay audit

Pay audits are just one of many employee-centric audits a company can choose to conduct to ensure they offer the best options to employees while remaining competitive in their industry.

A pay audit typically looks at the current wages of employees to determine if they are being paid fairly. Factors such as race, religion, age, gender, and length of service may all be considered. The auditor may also look at wider stats related to typical salaries for similar roles elsewhere in the industry and in the location of the business to help drive recommendations.

Environmental audit

Environmental audits have become more popular in recent years as companies become more aware of the impact they have on our climate. Currently, the vast majority of SMEs in the UK don't have to report their carbon emissions. However, as we move towards greener solutions, many companies may want to make the switch. An environmental audit, whether done internally or handled by expert external auditors, can help to determine recommendations for improving sustainability.

This may also prove to be a key part of acquiring new investors or partners. If they only wish to form connections with companies dedicated to pursuing sustainable business practices, an audit may be needed to help inform changes.

Supply chain audit

Proper management of supply chains can be critical for many companies. An audit can help to examine weaknesses in existing supply chains and can then make recommendations to help diversify and strengthen them.

Supply chain diversification is a key risk management practice all businesses must face. The knock-on effect of losing a supply chain is far too great — securing adequate supplies is key to, in turn, meeting goals and delivering targets.

Quality control audit

Quality control audits are important for manufacturers who wish to ensure they meet consistent standards for products — whether these standards are set internally or by regulatory bodies. A quality audit report may be a subsection of an overall compliance or operational audit, or it may be commissioned in its own right.

It can also be used to assess delivery practices and customer experience to ensure a high level of quality is delivered across all aspects of the company.

Remain compliant with C2 Meridian BCMS

Audits are a great way to discover the needs of a business and to determine recommendations for future actions. Since they are so flexible, they can be used to target any area of the company, and the introduction of an external auditor can mean that a team member does not need to take on the extra burden of conducting the audit.

The value that can be gleaned from an audit cannot be denied. Whether it is an audit required by regulatory bodies or just one that the company wishes to undertake for a greater understanding of its operational processes, these important business functions should not be shied away from.

Audits often form an important part of business compliance and continuity standards. C2's Meridian BCMS allows you to track and manage your internal compliance needs in one place. Complete internal audits, manage regulatory standards, and ensure your business is compliant no matter how your industry may shift and change. Book a demo today to find out more.

Written by Donna Maclellan

Lead Risk and Resilience Analyst at Continuity2

With a first-class honours degree in Risk Management from Glasgow Caledonian University, Donna has adopted a proactive approach to problem-solving to help safeguard clients' best interests for over 5 years. From identifying potential risks to implementing appropriate management measures, Donna ensures clients can recover and thrive in the face of challenges.

Written by Donna Maclellan

Lead Risk and Resilience Analyst at Continuity2

With a first-class honours degree in Risk Management from Glasgow Caledonian University, Donna has adopted a proactive approach to problem-solving to help safeguard clients' best interests for over 5 years. From identifying potential risks to implementing appropriate management measures, Donna ensures clients can recover and thrive in the face of challenges.